You can choose from plenty of funded trading programs, but you can’t guarantee the reliability of all those programs. So when you select a funded trading program, you first need to check the program’s reliability, then the rules, then the prices, then other details that may be important for you and your trading skills and knowledge.

As many of our website readers may already know, we only review trusted-funded trading accounts; we never highlight any program we don’t trust. It doesn’t mean that we have reviewed all programs in the market of funded trading; it just means that you can’t find scam programs on our website.

In this article, we will talk only about the most trusted funded trading programs for futures traders or forex traders. Then, we will introduce the founders of those programs, show some reviews on the internet, and talk about technical things, including rules, prices, and more.

1- Topstep – Futures

Topstep is the world’s most trusted and transparent funded trading program; its community of futures traders is the largest and most satisfied, according to the user’s reviews on the internet.

They were providing separate programs for both; forex traders and futures traders. But now they only offer the futures program.

The Futures program was called TopstepTrader. But Topstep has changed the name to Topstep Futures.

Here is a video introduction to the program here: Topstep Introduction Video.

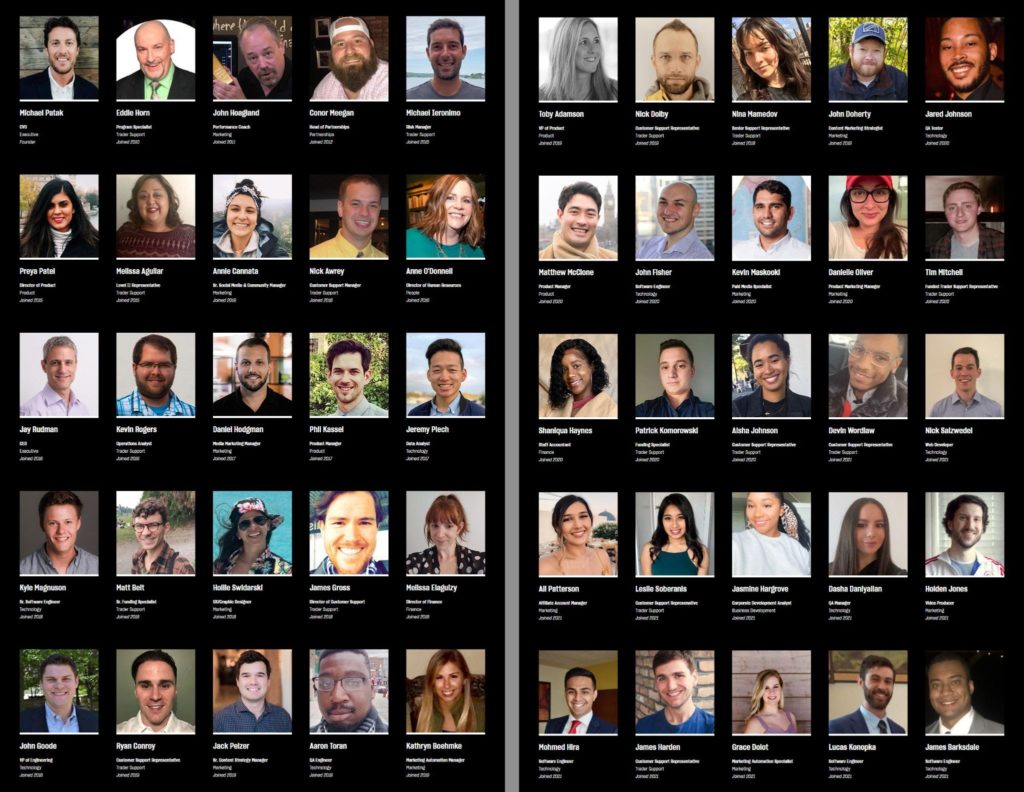

Who are the Founders of Topstep?

Michael Patak founded Topstep in 2010; the company has since been based in Chicago. Michael Patak was not alone when he founded Topstep; below, you can see photos of the whole team of Topstep, from professional traders to business managers to marketers to developers, all of what a large-size company needs. The team’s oldest members are Eddie Horn, John Hoagland, and Conor Meegan.

What are the Offers and Prices of Topstep?

As we already said, Topstep-funded trading programs have offered Futures traders. So Topstep offers three evaluation plans for Futures traders.

The evaluation at Topstep is called “The Trading Combine.” It’s a 2 step evaluation, the first step takes a minimum of 5 days to complete (no maximum days), and the second step depends on the trader’s performance. If he is so good, he can complete it in less than four days, but it may take longer.

What Are Topstep Offers For Futures traders?

The Buying Power of each plan defines the three plans offered by Topstep Futures, but the most important here is the total number of contracts you can use in every account size. The prices range from $165 to $375.

Here are the Trading Combine plans for Futures traders:

| Buying Power(Max Contracts) | Price |

|---|---|

| $50K (5 contracts) | $165/mo |

| $100K (10 contracts) | $325/mo |

| $150K (15 contracts) | $375/mo |

| Get 20% off here |

What are the Rules of Topstep?

As with all programs, there are some rules that traders need to follow to prove their talent and risk management skills. Here are the leading rules traders must follow for forex and futures plans.

What are the Rules of Topstep Futures?

- Trade minimum five days (for step 1 only).

- Respect the Consistency Target (for step 2 only).

- Don’t hit the daily loss limit.

- Don’t hit the Trailing Drawdown.

- Follow the scaling plan.

- Reach the profit target.

- Don’t trade during the weekend and between 3:10 PM and 5:00 PM CT every day.

- Trade only permitted products.

Learn more about Topstep Futures rules here.

What are the trading platforms allowed at Topstep?

What are the Futures platforms allowed at Topstep?

For Topstep Futures traders, almost all platforms are allowed to trade in. here are the recommended and free platforms when trading futures at Topstep:

TSTrader, TradingView, and NinjaTrader.

Here are the other platforms that you can use:

Sierra Chart, T4, Jigsaw Daytrader, MultiCharts, R|Trader Pro, VolFix, Trade Navigator, ATAS OrderFlow Trading, MotiveWave, Bookmap, and Investor/R.T.

Topstep Reviews

The reviews for Topstep are just incredible; people love the platform. Take a look at the Topstep reviews at TrustPilot, there are 1,325 Reviews, and the score is 4.3, which is very good.

Traders have confirmed that they received payment, like the rules and support.

The 4% that rated 1 star had general problems with the rules that were hard to follow.

Pros and Cons of the Topstep program

Pros of Topstep funded trading program

- Free education is available to traders.

- Funded traders can keep the first $5000 of their profits.

- After that, the profit split is 80/20; 80% of profits are for traders.

- Topstep offers 14 days of free simulated trial accounts. (Access Topstep free trial here)

Cons of Topstep-funded trading program

- You can’t get an accurate idea of the evaluation’s cost since you don’t know when you can finish the challenge.

- Resetting the account costs $99.

- The challenge “Trading Combine” is a two steps evaluation.

2- Apex Trader Funding – Futures

Apex Trader Funding is a growing company that provides a funded trading program for Futures traders. Besides being a trusted-funded trading program, Apex has the most straightforward rules in the market of funded trading programs. Very few rules to respect, and there is even an Auto Reject option if you broke a rule by mistake, like “The maximum contracts allowed” or “Trading times allowed.” Unfortunately, this option isn’t available on some platforms.

Who are the Founders of Apex?

Apex was founded by Darrell Martin, a rancher and a day trader at the same time. The mother company is Apex Investing, and it was born in the year 2008. It is an Educational platform that helps traders better understand the market. It has grown into a flourishing community of traders comprising more than 30,000 members in at least 150 countries.

Apex Trader Funding was officially launched in 2021.

As of December 2021, the company has provided futures traders with funds of over $150 million, with many of those traders having withdrawn profits already.

What are the Offers and Prices of Apex?

Apex offers multiple account sizes for futures traders with different prices:

(Click here and get 50% off by using coupon code TF50)

| Account size | Number of contracts | Price of challenge |

|---|---|---|

| $25K | 4 (20 micros) | $147/mo |

| $50K | 10 (20 micros) | $167/mo |

| $75K | 12 (24 micros) | $187/mo |

| $100K | 14 (28 micros) | $207/mo |

| $150K | 17 (34 micros) | $297/mo |

| $250K | 27 (54 micros) | $517/mo |

| $300K | 35 (70 micros) | $657/mo |

What are the Rules of Apex?

As we already said, Apex has fewer rules compared to other funded trading programs. Here are all the rules:

- Meet The Profit Goal.

- Trade A Minimum Of 10 Trading Days.

- Don’t Hit the Trailing Threshold Max Drawdown.

That’s it. You can get more detailed information about Apex here.

What are the trading platforms allowed at Apex?

Before using any trading platform, you must first download and connect to Rithmic RTrader Pro.

The recommended platforms from Apex Trader Funding are:

- NinjaTrader 7

- NinjaTrader 8

But you can also use many other platforms like:

Wealthcharts, Atas, Jigsawtrading, Bookmap, Linnsoft, Motivewave, Optimus Futures, Multicharts, Quantower, Agenatrader, Overcharts, Tradenavigator, Volfix, Tiger Tradesoft, Tslab, Quick Screen Trading, Qscalp, Bluewater Trading Solutions, and Sierra chart.

Apex Reviews

As we already said, the funded trading program started in 2021, so there are still few reviews about it on the internet. But the score until now is excellent.

Apex reviews from TrustPilot are promising; more than 100 people have found the program excellent, with a 4.8 score.

Traders love the easy-to-follow rules from Apex, the affordable prices (use promo code TF50 for 50% off), and the excellent support. They also love how fast they get funded and how easily they can withdraw their profits.

Pros and Cons of the Apex program

Pros of Apex futures funded trading program

- The evaluation process only involves one step.

- Traders can have multiple accounts under a single login detail.

- There are no daily drawdowns.

- The process of funding is rapid.

- A scaling plan is absent during the evaluation.

- The profit-sharing ratio is available at 90:10, which means 90% of the profit belongs to the traders.

- Unrestricted license to NinjaTrader.

Cons of Apex futures funded trading program

- Withdrawals can only be made once a month.

- The trailing drawdown is active during evaluation, so traders must be very aware when executing trades.

3- Leeloo Trading – Futures

Before Apex, there was Leeloo Trading, a futures-funded trading account that has almost the same rules as Apex.

There are just a few differences between those two, including that you can hold positions overnight during practice at Leeloo, and there are two options when you get funded at Leeloo Trading. Still, at Apex, there is only one option.

Who are the Founders of Leeloo Trading?

Leeloo Trading was founded in 2019 by a businesswoman called Jody Dahl; she is also a rancher from the third generation of a family of farmers and ranchers. Jody Dahl created the company with the help of Jacque L Jacobsen and Brett Debruycker, but they are silent associates, and she is the real manager and the leader of this company.

The mother company was Natural Trading LLC, but all of its community moved to the fast-growing company, Leeloo Trading.

| Jody Alise Dahl Founder and CEO |

What are the Offers and Prices of Leeloo Trading?

Leeloo Trading offers six standard challenges for its traders, plus two unique challenges: “Leeloo Express” and the Glide.

Leeloo Express is the most famous offer from Leeloo Trading because its price is only $77, but you must complete it in less than 14 days.

The Glide is a micro contracts trading account where you can trade 20 micro contracts.

You can get 15% off all offers by clicking here and using this coupon code: TF15 (this code is unavailable for Leeloo Express).

Here are all offers and prices, and also the number of contracts allowed in every account size:

| Offer name | Account size | Number of contracts | Price of challenge |

|---|---|---|---|

| Aspire | $25.000 | 3 contracts | $150 |

| Launch | $50.000 | 8 contracts | $180 |

| Climb | $100.000 | 12 contracts | $220 |

| Cruise | $150.000 | 15 contracts | $305 |

| Burst | $250.000 | 25 contracts | $525 |

| Explode | $300.000 | 30 contracts | $675 |

| Special offers | |||

| Leeloo Express | $100.000 | 12 contracts | $77 (14 days) |

| Glide/Micro | $100.000 | 20 micro contracts | $145 (No trailing drawdown) |

What are the Rules of Leeloo Trading?

The Leeloo trading-funded trading program has almost the same rules as Apex, meaning fewer rules than other funded trading programs.

But with Leeloo Trading, you can hold positions overnight and on weekends too !!!!

Leeloo Trading Standard challenges

Here are all the rules for the standard accounts:

- Meet The Profit Goal.

- Trade A Minimum Of 10 Trading Days.

- Don’t Hit the Trailing Drawdown.

That’s it. You can get more detailed information about Leeloo Trading here.

Leeloo Express

Here are all the rules for Leeloo Express:

- Meet The Profit Goal.

- Trade A Maximum Of 15 Calendar Days.

- Don’t Hit the Trailing Drawdown.

The Glide

Here are all the rules for the Glide option:

- Meet The Profit Goal.

- Trade A Minimum Of 10 Trading Days.

- Don’t Hit the Max (static) Drawdown

- Max contract limit = 20 Micro or 2 standard contracts

What are the trading platforms allowed at Leeloo Trading?

Leeloo Trading provides free access to Rithmic Pro and a free SIM license key to use NinjaTrader 7 and NinjaTrader 8.

And you can also use the following platforms to trade Leeloo Trading challenges:

EdgeProX, MotiveWave, Multicharts, ATAS, Finamarksys, Jigsaw Daytrader, Trade Navigator, VolFix, Bookmap X-Ray, Investor/RT, Sierra Charts, and OptimusFLOW

Leeloo Trading Reviews

Even if the program is trusted and reliable, there are very few reviews of the Leeloo Trading platform on the internet.

There are less than 50 reviews at Trustpilot for Leeloo Trading, but the current score is 4,3.

The company needs to market its program to get more traders to try it.

But in general, people who like Leeloo Trading like the great support and easy-to-follow rules.

Pros and Cons of the Leeloo Trading program

Pros of Leeloo Trading futures funded trading program

- More comprehensive ranges for Trailing Drawdown and number of contracts.

- Low reset fees.

- Minimum trading days for the challenge.

- You can have up to 6 accounts.

- You will get 100% of your first $12,000 profit earned in the funded account.

- The profit share is 90% for traders.

- Get a Free NinjaTrader license key.

- After passing the Leeloo Express, you will be refunded.

Cons of Leeloo Trading futures funded trading program

- Trailing Drawdown during the challenge.

- No education services.

4- FTMO – Forex

FTMO is a very trusted Forex-funded trading program.

They also provide a 2 steps evaluation for traders to be eligible for funding. The main differences between FTMO and Topstep are:

- First, FTMO offers a funded trading program only for forex traders.

- Second, FTMO offers a Scaling Plan for funded traders that allows them to grow their account size.

Who are the Founders of FTMO?

Otakar Suffner founded FTMO in Prague, the Czech Republic, in 2014. Otakar Suffner is a professional trader and a successful businessman born and raised in Prague.

Many members of the FTMO team are from different nationalities, including managers, professional traders, marketers, and more.

What are the Offers and Prices of FTMO?

As we already said, FTMO offers evaluations for only Forex traders. They have five account sizes, with 2 options for every account size that traders can choose from Normal risk or Aggressive risk. And the prices differ from €155 to €1 080 according to account size and the normal or aggressive option.

The aggressive option has different leverage, maximum Loss, and profit targets.

Here are the prices of every account size:

| Account size | Normal | Aggressive |

|---|---|---|

| $10,000 | €155 | €250 |

| $25,000 | €250 | €345 |

| $50,000 | €345 | €540 |

| $100,000 | €540 | €1 080 |

| $200,000 | €1 080 | ******* |

What are the Rules of FTMO?

The rules at FTMO are also called “the trading objectives.” The same rules are imposed on the normal and the aggressive option, but the numbers and percentages differ.

And as we already said, there are 2 steps in the FTMO evaluation:

- First step: FTMO Challenge.

- Second Step: The Verification.

Normal account

Here are the normal risk option rules for the first step (called FTMO Challenge) and the second step (called The Verification). This example is for the $10k account size:

| The Rules | FTMO Challenge | Verification |

|---|---|---|

| Minimum trading days | 10 days | 10 days |

| Maximum trading days | 30 days | 60 days |

| Maximum Daily Loss | $500 | $500 |

| Maximum Loss | $1000 | $1000 |

| Profit Target | $1000 | $500 |

| Leverage | 1:100 | 1:100 |

Aggressive account

Here are the aggressive risk option rules for the first step (FTMO Challenge) and the second step (The Verification). This example is for the $10k account size:

| The Rules | FTMO Challenge | Verification |

|---|---|---|

| Minimum trading days | 10 days | 10 days |

| Maximum trading days | 30 days | 60 days |

| Maximum Daily Loss | $1000 | $1000 |

| Maximum Loss | $2000 | $2000 |

| Profit Target | $2000 | $1000 |

| Leverage | 1:100 | 1:100 |

What are the trading platforms allowed at FTMO?

FTMO allows trading on the most known Forex platform, which are:

- MetaTrader 4

- MetaTrader 5

- cTrader

FTMO Reviews

As we already said, this is a list of Trusted-funded trading programs, and FTMO is a platform that has gained trust among traders worldwide.

Reviews from traders are great. For example, the FTMO reviews from TrustPilot, which are more than 2000 reviews, with a score of 4,8 stars, are massive.

Traders love how professional the platform and the team are, the rules, the honest people behind FTMO, and the easy process to withdraw profits.

Pros and Cons of the FTMO program

Pros of FTMO forex-funded trading program

- Traders can retain 80% up to 90%.

- Traders are allowed up to a 10% drawdown on their funded account.

- There is a free trial version of the evaluation course.

- Quick and easy withdrawal of funds.

- Traders are given access to excellent tools and education.

- The challenge is only a one-time fee, and no monthly payments are requested.

- The fees will be refunded in your first withdrawal if you win the evaluation.

Cons of FTMO forex-funded trading program

- The cost for the evaluation ranges between $180 and $1300.

- There are 2 steps to pass the evaluation.

5- Earn2Trade – Futures

Earn2Trade is the most liked Futures funded trading program among professional traders, especially the 60 days challenge called the Gauntlet.

They also provide a Scaling Plan option allowing traders to go from a $25k account to a $200k account. This option is called Trader Career Path.

But in our review, we will focus more on the Gauntlet Mini, the most famous option offered by Earn2Trade.

Earn2Trade is designed only for Futures traders.

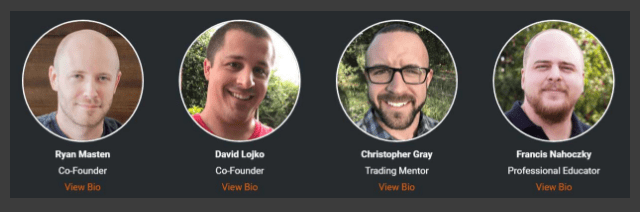

Who are the Founders of Earn2Trade?

The founders of Earn2Trader are Ryan Masten and David Lojko. But Ryan Masten left Earn2Trade in July 2020. And now, Earn2Trade is managed by a professional team of professional traders, mentors, marketers, and more.

The team has multiple professional mentors who have passed the National Futures Association examinations, Series 34 and 3.

What are the Offers and Prices of Earn2Trade?

Earn2Trade offers multiple products for professional traders and beginners. Here are all the different challenges that Earn2Trade offers:

- The Gauntlet Mini (Recommended)

- Trader Career Path

- The Gauntlet

The prices range from $150 to $350.

The Gauntlet Mini

Here are the sizes of the accounts offered in the Gauntlet Mini™. You can get great discounts by clicking here.

| Account size | Number of allowed contracts | Price of challenge |

|---|---|---|

| 25000$ | Up to3 contracts | 150$ |

| 50000$ | Up to6 contracts | 170$ |

| 75000$ | Up to9 contracts | 245$ |

| 100000$ | Up to12 contracts | 315$ |

| 150000$ | Up to15 contracts | 350$ |

Learn more about The Gauntlet Mini here.

Trader Career Path

Trade Career Path is a specially funded trading program recently introduced by Earn2Trade.

The presence of a scaling plan in this option gives traders access to increasingly significant capital as they grow their accounts.

There is only one account size, and the cost of signing up is $150/mo, but you can get an excellent discount here.

Learn more about Trade Career Path here.

The Gauntlet

There is only one package in the Gauntlet, which will cost you a one-time payment of $429, allowing you to manage a 25000$ futures trading account for exactly 60 days.

What are the Rules of The Gauntlet Mini by Earn2Trade?

Here are all rules that the traders need to respect when accessing the Gauntlet Mini Challenge:

- Trade a minimum of 15 trading days.

- Do not reach the maximum daily Loss.

- Do not use more contracts than allowed (The Progression Ladder).

- Do not reach the trailing drawdown.

- Trade only during approved times.

- Maintain consistency.

What are the trading platforms allowed at Earn2Trade?

The trading platform recommended by Earn2Trade is NinjaTrader®.

But you can trade using multiple other platforms; here is the complete list:

Finamark, R | Trader & R | Trader Pro, Overcharts, Agena Trader, Inside Edge Trader, Investor RT, MotiveWave, MultiCharts, Bookmap, Photon, QScalp, QSI- Quick Screen Trading, ScalpTool, Trade Navigator, Volfix.net, Jigsaw Trading, ATAS Order Flow Trading, Sierra Chart, and Quantower.

Earn2Trade Reviews

Until now, there are more than 800 reviews at TrustPilot for Earn2Trade, and the score is impressive: 4.6 stars.

The Earn2Trade platform is respected and trusted among many traders, especially in Latino communities. Traders confirmed that Earn2Trade appreciates its commitment, including profit shares and withdrawals.

Some traders don’t like that Earn2Trade push you immediately when you break a rule. We think Earn2Trade should fix that by adding an automatic option rejecting actions that don’t stick to the rules.

Pros and Cons of the Earn2Trade program

Pros of Earn2Trade funded trading program

- Earn2Trade offer multiple courses and training for all levels, beginner to advanced.

- The profit split is 80/20, so traders can take 80% of the profits when they get funded.

- After being funded, you can withdraw your profits on the first day; the minimum withdrawal amount is 100$.

- There is only one step evaluation, and the minimum trading days is only 15 days.

- Trading during news is also allowed.

Cons of the Earn2Trade funded trading program

- when you break one of these rules, even by mistake, your account will be closed immediately.

- Like Topstep, You need to respect the consistency rule; if your best day profit is more than 30% of your total profit, you need to continue trading until your trading matches the consistency rule.

- No free trial.

6- City Trader Imperium – Forex

City Trader Imperium, or CTI, is a trusted forex-funded trading program that offers forex challenges plus Direct Funding for its traders. CTI also offers trading education for a large trading community in the U.K. and worldwide.

What makes the CTI-funded trading program powerful is offering the Direct funding option, where traders need just to pay a one-time fee to get funded and start making money, with no need to pass via a challenge to get that funded account.

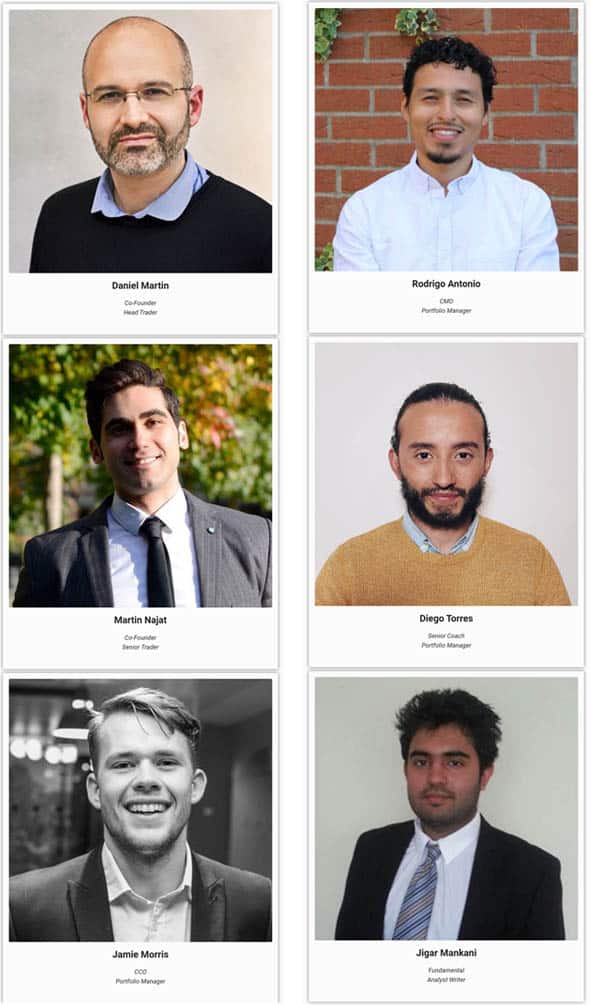

Who are the Founders of City Trader Imperium?

Daniel Martin and Martin Najat founded the city Trader Imperium. CTI is a privately-owned company registered in England and Wales with no regulation by the FCA – Financial Conduct Authority (the highest financial governing body in the United Kingdom), which is why the company does not undertake regulated activities but still keeps its activities in compliance with FCA guidelines. Like most other funded trading programs, the company maintains its activity under an educational purpose.

What are the Offers and Prices of City Trader Imperium?

As we already said, CTI offers standard evaluations like most other companies and a direct funding option. Those two options come in multiple account sizes and prices.

The Funded Trading Evaluation

There is a minor difference between CTI and other challenges in this option. When you want to access a trading evaluation, for example, the $10k account, in the evaluation, you will be trading a $2,500 trading account first; when you pass the challenge, you get funded with the $10k account.

Here are the account sizes and prices for CTI: (Get 5% off with this special link and use this promo code CTIDISCOUNT5%)

| Evaluation account size | Desirable Funded account size | The sign-up fee |

|---|---|---|

| $2,500 | $10,000 | £109 = $149 |

| $5,000 | $20,000 | £199 = $272 |

| $10,000 | $40,000 | £379 = $517 |

| $12,500 | $50,000 | £449 = $612 |

| $17,500 | $70,000 | £649 = $885 |

The direct funding account

The prices are a little bit higher for the direct funding option since you don’t have to pass via an evaluation or a test period; you will get funded immediately.

Here are the account sizes and prices for the direct funding account:

| Account size | The sign-up fee |

|---|---|

| $20,000 | £999 = $1354 |

| $40,000 | £1,799 = $2438 |

| $50,000 | £2,199 = $2980 |

| $70,000 | £3,099 = $4200 |

(Get 5% off with this particular link and use this promo code CTIDISCOUNT5%)

What are the Rules of City Trader Imperium?

Here are the rules and trading objectives for both options:

The Funded Trading Evaluation rules and trading objectives

- Reach the Profit target. 7% of the starting balance.

- Don’t hit the Max loss. 5% of the starting balance.

- Trade-allowed instruments: Gold and Forex for the $10k account, and Gold and Forex and Indices for other accounts.

- Leverage: 1:10.

- You can only trade news before or after 3 minutes.

The direct funding account

- Reach the Profit target. 10% of the starting balance.

- Don’t hit the Max loss. 5% of the starting balance.

- Trade-allowed instruments: Gold and Forex and Indices for all accounts.

- Leverage: 1:10.

- You can only trade news before or after 3 minutes.

Learn more about City Trader Imperium here.

What are the trading platforms allowed at City Trader Imperium?

City Trader Imperium offers trading on only one platform, MetaTrader 5 (MT5).

City Trader Imperium Reviews

As we already said, CTI is widely known among the U.K. community and receives some good reviews from U.K. traders and traders worldwide.

There are more than 250 reviews for CTI at TrustPilot, and most of those reviews are very good, with a score of 4.8 stars.

Traders like the fast support, the easy and well-explained rules, the professional tools available, and being able to be funded directly or after only one step of the evaluation.

Pros and Cons of the City Trader Imperium program

Pros of City Trader Imperium forex-funded trading program

- It has a wide array of products and services

- Traders have access to practical educational content

- There is professional coaching from seasoned and veteran traders

- Availability of a scaling plan that gives the potential to manage up to $4,000,000.

- Availability of a Direct funding option that doesn’t need to pass an evaluation.

Cons of City Trader Imperium-funded trading program

- The profit shares for traders are low compared to other companies; it starts from 50% to 70%.

- The leverage is too low: 1:10; some traders may not like it.

- The signup feesignupa bit high, especially for the direct funding option.

7- The5%ers – Forex

The5%ers is a funding and growing trading company that provides traders with an opportunity to have access to a funded account to trade the forex market.

Like CTI, The5ers platform offers standard funded trading programs and also a direct funded program.

Trading insights, educational articles, and analyses help traders compete in the forex market and succeed. This way, the selected traders have an enhanced trading career, giving them a chance to earn higher profits consistently.

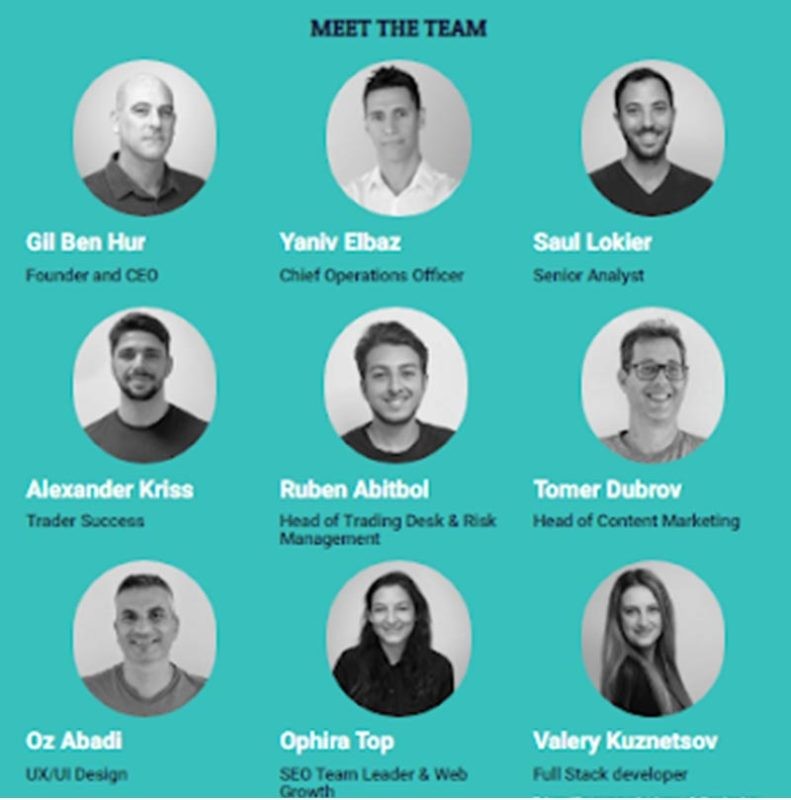

Who are the Founders of The5%ers?

The5ers was founded by Gil Ben Hur, a professional trader with in-depth experience in the market since 2007. But Gil Ben Hur is not the only person behind this company; there is a team of experienced traders and engineers that help improve the program.

Gil Ben Hur established the company in 2016, and it is based in Israel with a branch office in the United Kingdom.

What are the Offers and Prices of the The5%ers?

The5ers platform offers three primary programs for traders that are willing to be funded:

Instant Funding Program

In this program, the trader doesn’t have to pass an evaluation process to get funded; he will immediately access the funded account.

There is an option for getting a low-risk or aggressive account, but those prices are the same.

Here are the prices for each account size:

| Account size | Instant funding | Participation Fee |

|---|---|---|

| $24,000 | $6,000 | $275 (get 5% off here) |

| $40,000 | $10,000 | $450 (get 5% off here) |

| $52,000 | $13,000 | $565 (get 5% off here) |

| $80,000 | $20,000 | $875 (get 5% off here) |

P.S.: In the first funded account, you will be funded with only 25% of the actual account size; when you reach the trading objectives, you will then be able to trade with 100% of the account size and with The5ers trading growth program, you can have access to up to $2.5M.

The FREESTYLE Program

With the FreeStyle program, you can access only one account size, which is a $50,000 evaluation account, and the price to access this evaluation is €550.00, but you can get a good discount by using this link.

This offer comes with a growth program allowing you to grow your account size to $3M.

The $100K BOOTCAMP account

The $100K Bootcamp program includes one offer with 3 steps to complete. That means that you have to pass three challenges to get funded. But the entry fees are just €85.

Here is the info about the three challenges that you need to pass:

| Starting Balance | Maximum Loss (5%) | Profit Target (6%) | |

|---|---|---|---|

| Challenge 1 | $25K | $1,250 | $1,500 |

| Challenge 2 | $50K | $2,500 | $3,000 |

| Challenge 3 | $75K | $3,750 | $4,500 |

What are the Rules of The5ers?

Instant Funding Program

To be able to withdraw your profits from the Instant Funding program, you must respect the following trading objectives:

- Reach the target profit: 6% for the low-risk option and 12% for the aggressive option.

- Maximum trading days to reach the target: 6 months for the low-risk option and 2 months for the aggressive.

- Max loss: Don’t lose more than 4% in your account (for both options).

- Leverage: 1:6 for low risk and 12% for aggressive.

You will grow your account size according to the The5ers growth trading program when you meet all the trading objectives.

The FREESTYLE Program

Here are the rules for the FreeStyle option:

- Trade with MT5 Netting.

- Open and close 100 positions.

- Performance factor > 2.

- Winning factor: win at least 30 positions.

- Respect the Consistency rule.

Learn more about: Performance factor, Winning factor, and Consistency rule here.

The $100K BOOTCAMP account

Here are the rules for the Bootcamp option:

- A 1% stop loss is required in all positions.

- Leverage 1:10.

- Don’t hit Max loss: 5%.

- Reach Profit target: 6%.

- Win all the 3 challenges.

What are the trading platforms allowed at The5ers?

The5ers allow trading on only one platform, MetaTrader 5 (MT5).

The5ers Reviews

Besides being a well-trusted company, The5ers has got good reviews from traders worldwide for their programs.

The5ers at TrustPilot scored 4.8 stars from over 450 traders, which is a perfect score.

Traders like the friendly customer support, the honesty of the program, the low price of their Bootcamp offer, the extended time to pass the challenge, the well-defined rules, and also being able to pass the challenge and make withdrawals.

Pros and Cons of The5ers program

Pros of The5%ers forex funded trading program

- Availability of direct funding option.

- Access to educational tools and support from professional traders.

- Opportunity to access funding of up to almost $4 million.

- Trading conditions are less strict.

- Traders can hold overnight positions and over the weekend.

- Traders have increased the time duration to complete challenges.

Cons of The5%ers funded trading program.

- Traders only get 50% of the profit, which is low compared to other companies.

- The amount of the participation fee can put off some traders

- You can only use the MetaTrader5 platform.