Understanding the various rules imposed by different funded trading programs is crucial, as these rules truly test more than just your trading skills—they test your overall approach and discipline.

After clarifying the Trailing Drawdown rule, which is a common feature across most funded trading programs, it’s important to explore another critical rule: “The Scaling Plan.” This rule, though it may be known by different names on various platforms (for example, Earn2Trade calls it “The Progression Ladder”), plays a significant role in a trader’s success. At Trading Funder, we stress the importance of grasping these rules to help traders effectively navigate and succeed within these programs.

Are there many definitions for the Scaling Plan?

In the field of funded trading programs, The Scaling Plan may refer to two different things:

- Having access to more funds when you continue making good progress.

- Having access to more contracts when you make a certain profit.

1- Having access to more funds

For example: A funded trader starts with a $20k account, then when he achieves some objectives, he will get a $30k account, then when he achieves some bigger objectifs, he can get a $50k account…

This can also refer to getting more profit split. From 50% to 60% …

- In this case, we are talking only about a funded trader, it means a trader who has already won the challenge and is trading on a funded account.

Here are some platform that uses this option, and the names given to it:

| The platform | The name giving to this rule |

|---|---|

| The5ers | Growth Plan |

| Earn2Trade | Scaling Plan |

| City Traders Imperium | Scaling Plan |

| FTMO | Scaling Plan |

2- Having access to more contracts

Only futures funded trading programs use this option.

For example: a trader can trade only 2 contracts, but when he realizes a certain profit, he will be able to trade with 3 contracts. Then when he realizes more specified profits, he can trade 6 contracts …

- In this case, it can be both a funded trader or a trader that still didn’t pass the challenge.

Here are some platform that uses this option, and the names given to it:

| The platform | The name giving to this rule |

|---|---|

| Earn2Trade | The Progression Ladder |

| Topstep | Scaling Plan |

| Leeloo Trading | Scaling Plan |

| Apex | They don’t use Scaling Plan |

In our article, by Scaling Plan, we mean the second option: the rule that lets you have access to more contracts when you make a certain profit.

What is the scaling plan?

The scaling plan (known at Earn2Trade as The Progression Ladder) is a rule imposed by funded trading programs that controls how many future contracts you can use on your trading account.

Let’s be honest, most funded trading programs say that you are eligible to trade a certain amount of contracts when you purchase their challenge. But when you start your challenge, you will be faced with a scaling plan that doesn’t allow you to trade all contracts on the first day.

So for example, you will be able to trade with only two contracts, and you have to earn a certain benefit to use more contracts.

Example:

The $50k challenge at Earn2Trade allows you to trade up to 6 contracts.

But when you start a challenge with Earn2Trade, you can trade only 2 contracts in your first days.

You need to earn first $1501 to be able to use 4 contracts.

And when your earnings are equal or more than $2001, you can then trade with 6 contracts.

Why do funded trading programs impose a scaling plan?

Many funded trading programs use the scaling plan in their challenge and in their funded trading accounts too. So why is it so important for them to include a scaling plan?

In the challenge:

The scaling plan in challenges may be imposed by funded trading programs for many reasons. Here are some reasons:

- Traders can prove that they follow a good risk management strategy.

- Traders can prove that their earnings are not by chance.

- Companies can guarantee that their money will be in good hands.

- Some companies, that are interested more in getting challenge fees, may use this rule to eliminate a trader in the challenge quickly. Because a trader may use 3 contracts by mistake when he is allowed to use only 2. This way the company will eliminate the trader.

In the funded account:

Almost all funded trading programs use the scaling plan in their funded accounts, here are some reason:

- Companies can have a guarantee to not lose a big amount of dollars.

- Traders can follow a good strategy in risk management.

What are the Scaling Plan benefits for a trader?

Any trader may find the scaling plan a bad rule that restricts trading. But it is also a great benefit for traders, especially for new traders.

New traders may have difficulties in managing their money with a good risk management strategy. And as we mentioned in our previous article about the funded trading concept, funded trading programs are a nice way where traders can learn a good risk management strategy, and a scaling plan is one of the tools for that.

How does the Scaling plan work at Topstep?

Scaling plan at Topstep is used in step 2 of the challenge, and in the funded account.

There is no scaling plan rule for step 1 of the challenge.

Check here all the information that you need about Topstep for futures traders.

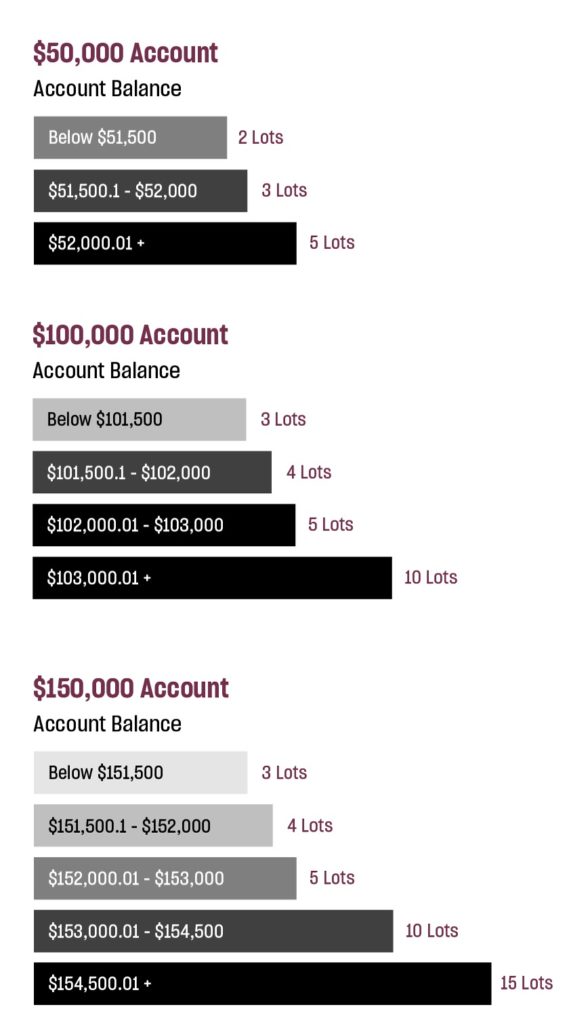

This following image shows you the number of contracts that you may trade in every account size, and the earnings needed to use more contracts.

Very important Notes about the scaling plan at Topstep:

- Topstep considers a micro contract as a full contract.

- If you trade more contracts than allowed, your trading account will be eliminated.

- In the Trading Combine (the Topstep challenge), when you reach the account balance needed to use more contracts, you can use added contracts the next day. It’s an automatic process after the end of the trading day.

- In the funded account, when you reach the account balance needed to use more contracts, you will have to email the Funded Account Specialist to upgrade your account, to use the additional contracts.

- In the funded account, there is an option where you can trade more contracts than allowed for your account balance. You must reach $5000 profits and contact Topstep to allow you more contracts.

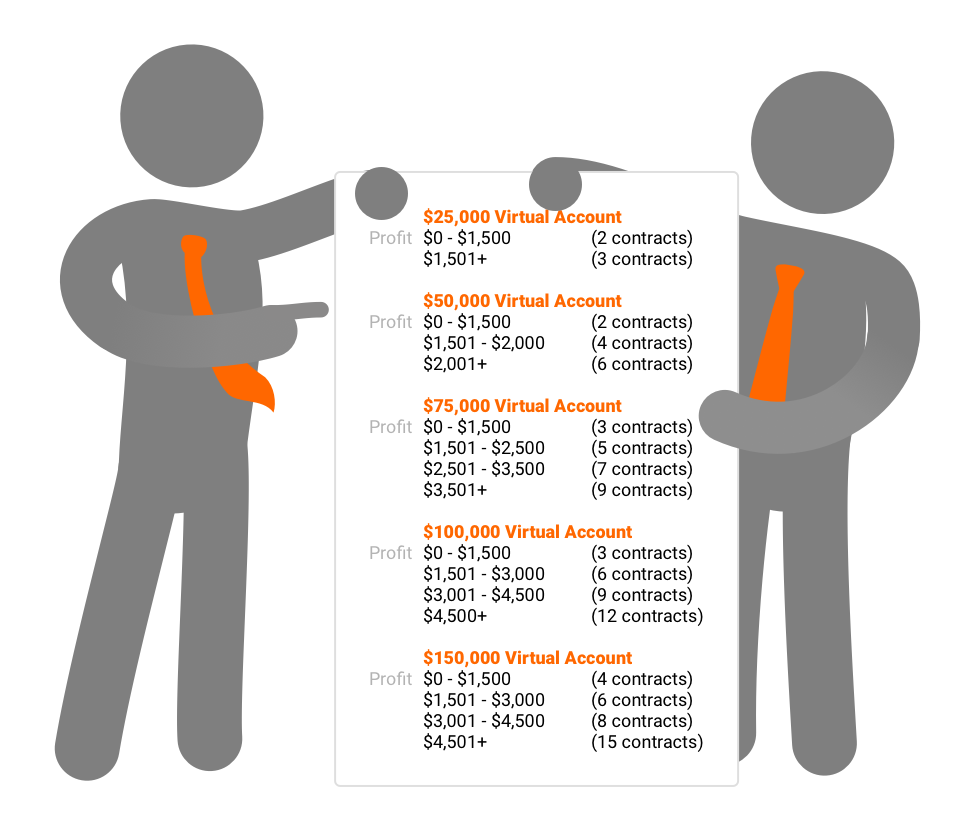

How does The Progression Ladder work at Earn2Trade?

The scaling plan as defined above is called at Earn2Trade as “the Progression Ladder”.

As you may know, Earn2Trade offers 2 types of challenges: The Gauntlet and The Gauntlet Mini.

Check here all information about Earn2Trade products.

There is no Progression Ladder for The Gauntlet challenge.

The Progression Ladder rule is used in The Gauntlet Mini and the funded account.

This following image shows you the number of contracts that you may trade in every account size, and the earnings needed to use more contracts.

Very important Notes about the Progression Ladder at Earn2Trade:

- Earn2Trade is not like Topstep, it doesn’t consider a micro contract as a full contract. So if you are allowed to use 2 contracts, you can trade either 2 contracts, or 1 contracts plus 10 micro contracts, or 20 micro contracts.

- If you trade more contracts than allowed, your trading account will be eliminated.

- In The Gauntlet Mini, when you reach the account balance needed to use more contracts, you can use added contracts immediately. It’s an automatic process that works intertrades. But Be careful, this may be a very bad option.

Example:

Let’s say that you are allowed to use only 2 contracts, then in a certain time, you reach $1501 profits or more. So now you are allowed to use 3 contracts. And you decided to use the third contract.

but while you are trading with 3 contracts, your profits drop below $1501. This will result in eliminating your account immediately. Since if you have less than $1501 profits, you are allowed to use only 2 contracts.

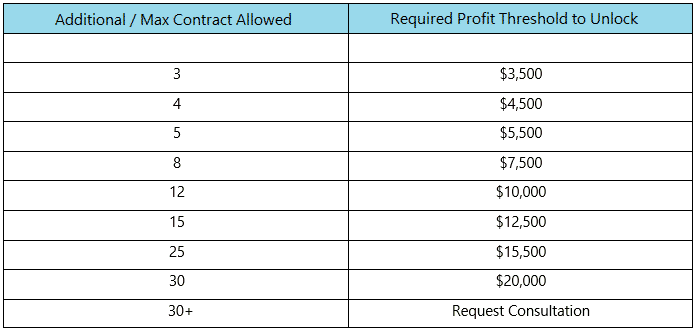

How does the Scaling plan work at Leeloo Trading?

Leeloo Trading may be the best option to use if you don’t want to limit the number of contracts in your account with a scallion plan, Because There is no scaling plan rule in the Leeloo Trading challenge.

And it is also not used in the funded account called “The Investor”.

The scaling Plan rule is used at Leeloo Trading only in the funded account called “The Accelerator”.

Check here all information about Leeloo Trading products.

This following table shows you the number of contracts that you may trade in every account size, and the earnings needed to use more contracts.

Important Notes about the scaling plan at Leeloo Trading:

As we already said, the scaling plan rule is only available in the Accelerator funded account. So here are some notes to take about the scaling plan if you want to choose the accelerator option:

- 1 contract = 10 micro contracts.

- If you trade more contracts than allowed, your trading account will not be eliminated. Leeloo Trading will simply reject your action and you can continue trading.

- You have to contact Leeloo Trading support when targeted profit is met, to allow you to use more contracts.

- When you reach your max position size which is 12 contracts, and after 60 days of trading 12 contracts, you can contact the support to allow you to use more contracts. And you can request even more contracts, you just need to to follow the table above, and always wait 60 days between these requests.

How does the Scaling plan work at Apex Trader Funding?

There is no scaling plan at all in the Apex Trader Funding program. So no worry at all about scaling plans at Apex.

Conclusion on Scaling Plan

Understanding the Scaling Plan, or “Progression Ladder,” is vital for traders in funded programs, as it controls how many contracts they can trade based on their performance. At Trading Funder, we stress that this rule, used by programs like Topstep and Earn2Trade, ensures that traders maintain discipline by limiting contract size until they achieve specific profit milestones. While Leeloo Trading stands out for not using the Scaling Plan in most accounts, Earn2Trade’s Gauntlet Mini™ and Topstep’s challenge enforce it strictly. For traders prioritizing flexibility, Leeloo might be preferable, but those seeking structured growth should consider Earn2Trade or Topstep.