WHAT IS City Traders Imperium?

City Traders Imperium or CTI is a prop trading firm that provides funding to selected traders through its funded trader program. It is also an educational company that operates an online educational trading community where useful trading tools and educational materials are made available to traders within that community.

What does CTI provide for traders?

Traders are given a platform through which they can leverage their trading skills while increasing their trading profits at an accelerated pace through a funded account from the company. But the great news here is that they provide direct funding options like the one provided by The5%ers direct funding program, which is another funded trading program.

CTI allows traders to manage up to four million dollars as long as they show their capability to manage such a huge size of capital. The major attributes that the company is looking for in traders are the appropriate trading psychology, excellent trading strategy, and a solid level of discipline. Traders with these attributes have a great chance of giving a good account of themselves in the trading program challenge.

Where does CTI come from?

CTI is a privately-owned company that is registered in England and Wales with no regulation by the FCA – Financial Conduct Authority (the highest financial governing body in the United Kingdom) which is why the company does not undertake regulated activities but still keeps its activities in compliance with FCA guidelines. Also, the company is not a type of financial institution and neither is it a broker nor does it engage in marketing for any brokerage services.

CTI funded trader program is designed in such a way that traders of any nationality have access to its practical educational evaluation which gives traders an opportunity to enhance their ability in compounding profits, risk management, and trading psychology.

Is CTI program suitable for organizations?

The CTI funded trading program is designed to only be suitable for individual traders rather than large organizations or groups of people and this is why the company usually requires traders to provide a valid ID as proof of identity and address to be sure that the trader is the only person trading an assigned funded account. There is no discrimination as to who can sign up for the program as long as the person is above 18 years of age.

WHAT ARE THE CTI OFFERS FOR FOREX TRADERS?

CTI offers 2 options for Forex traders: The evaluation option and the direct funding option.

The Funded Trading Evaluation

The goal of the company is to evaluate the trader’s consistency in profitable trading over a specific period as designated by the company. Therefore, the trader is expected to show sufficient trading skills during this phase and afterward.

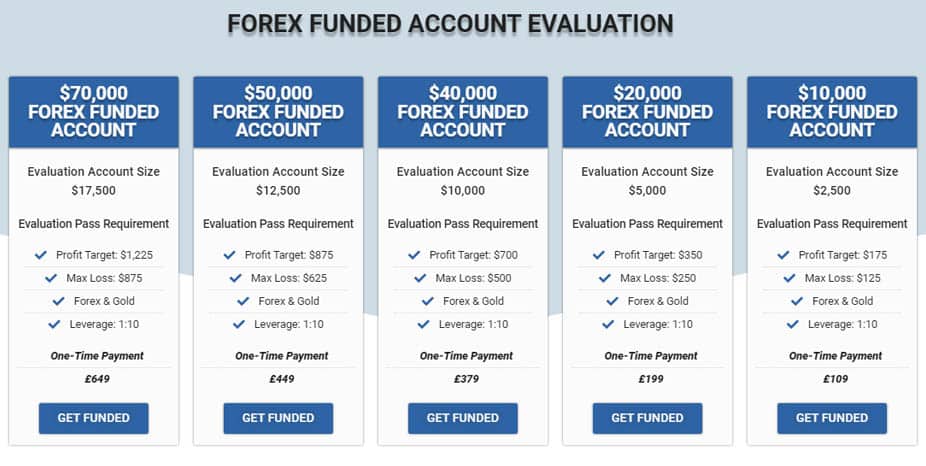

There are different accounts sizes in the evaluation that traders can choose from depending on the size of the funded account that they want, and each account has varying sign-up fees (usually a one-time payment). For the evaluation phase:

| Evaluation account size | Desirable Funded account size | The sign-up fee |

|---|---|---|

| $2,500 | $10,000 | £109 = $149 |

| $5,000 | $20,000 | £199 = $272 |

| $10,000 | $40,000 | £379 = $517 |

| $12,500 | $50,000 | £449 = $612 |

| $17,500 | $70,000 | £649 = $885 |

You can check more about the prices here.

The direct funding account

In this option, you don’t have to go through the evaluation process, you can get funded immediately. This option is called also Portfolio Manager. All you have to do is pay the one-time payment fees and you can get your funded trading account immediately, but you will have to respect some rules if you don’t want to lose that account.

The problem here is that the prices are extremely high for beginners, the lowest cost for the direct funding account is $1354.

Here are the prices for the direct funding or Portfolio Manager:

| Account size | The sign-up fee |

|---|---|

| $20,000 | £999 = $1354 |

| $40,000 | £1,799 = $2438 |

| $50,000 | £2,199 = $2980 |

| $70,000 | £3,099 = $4200 |

You can check more about the prices here.

WHAT ARE THE RULES AND CHARACTERISTICS OF CTI?

Main rules for the funded trading program:

These rules are effective for the evaluation and for the direct funding program

Profit target

That’s the profit that you need to make at the end of your trading period.

It is about 7% for the forex-funded trading evaluation, and 10% for the direct funding forex account.

Max loss

This is the max loss allowed in your account, if this value is reached, you lose the account automatically.

It is about 5% for the forex-funded trading evaluation, and also 5% for the direct funding forex account.

Instruments

These are the instruments allowed for trading in your account.

In the evaluation, you are allowed to trade Gold and Forex, but in the direct funding option, you are allowed to trade Gold, Indices, and Forex.

Leverage

The leverage is fixed at 1:10 for all accounts.

what is the Fee structure and Refund policy?

- Once the Evaluation funded account has been traded, CTI does not provide a refund of any sign-up fee to the funded trader.

- Traders should be aware that the sign-up fee does not serve as a deposit into a trading account of any sort.

- Only a one-time fee is charged by CTI to cover the trading costs and/or losses that may have been incurred by the trader during the Evaluation phase of the program.

- There are no monthly or recurring charges for the trader to worry about throughout the duration of the program.

- Once the funded account given to the trader has been traded, it is impossible for such an account to be downgraded to a smaller funded account or upgraded to a larger one.

The Trading Platform

- MT5 is the trading platform that CTI makes available to its funded traders.

- Total control of the trading platform is in the hands of the funded trader.

- The company refrains from interfering with the trading process of its funded traders unless such an individual is failing to comply with the company’s risk management policies.

- The MT5 trading platform provided by CTI is available on MAC and Windows PC.

What are the Restrictions of CTI Funded Trader Program?

- There is a prohibition on trading the funded trader program in conjunction with fellow traders that are active on the same account.

- If a funded trader should have more than one account with CTI, hedging is prohibited among accounts as each account will be treated separately.

- The company is against using the name of a different trader on one or more funded accounts.

- Funded traders at the Evaluation phase are allowed to open as many accounts as they want but traders in the Portfolio Manager phase are not allowed to have more than two accounts.

- Duplication of trades and orders by using a copy/social trading service is not allowed but the funded trader is permitted to copy trades from his/her other personal accounts into the CTI funded account.

- The company prohibits mirrored trading which involves the use of one expert advisor by a single trader on various accounts or a group of traders using the same expert advisor on different accounts at the same time and/or copying the same trades to different accounts at the same time either manually or using an expert advisor.

- The following trading techniques are prohibited:

- copy trading of other people’s signals

- any form of Tick Scalping strategies

- Reverse Arbitrage trading of any kind

- Hedge Arbitrage trading in any form

- Latency Arbitrage trading

- and using emulators

Traders that use any of these aforementioned techniques are in danger of having their Funded Trader Program terminated with no refund policy.

What are the Risk Management Policies?

- All funded traders are required to manage their positions under the specific guidelines and risk management policies stated on the CTI website.

- The company constantly observes the trading activities of its funded traders and gives them warnings whenever they violate any of its risk management policies.

- If a funded trader that has been warned then refuses to comply with the risk management policies, it is within CTI’s rights to terminate such a trader’s account and have them excluded from the Funded Trader Program.

- And whenever such a trader that had his/her account initially terminated is ready to comply with the company’s risk policies, they are free to apply again for the program.

When Termination of the Funded Trader Program may occur?

Termination may occur due to any of the following reasons:

- The trader reaches the maximum loss value on the funded account

- The trader is unable to comply with the risk policies for the two phases of the program.

- Misusing or abusing the program

- Using the program for a different purpose apart from the authenticity of individual trading.

- High-frequency trading, ultra-fast scalping, latency arbitrage trading, or similar styles of trading that CTI does not accept.

- Copy-trading, social trading, or any form of mirrored trading activity.

what is the Process of profit withdrawals at CTI?

The process varies from one phase to another and we will examine the process for each phase.

For the Evaluation phase:

- 50% profit share of the profit target will be paid to the funded trader by CTI.

- The 50% profit share is the net of all commissions, trading costs, overnight swaps, and spreads.

- Any profits accrued due to violating the risk policies will be deducted from the final profit target once the trader completes the evaluation phase. In such a case, the profit target is extended by the amount of profit made as a result of violating the risk policies.

- On the other hand, losses incurred due to violating the risk management policies of CTI will be deducted from the account balance.

For the Portfolio Manager phase:

- All profit share payments are made to the account of the funded trader through any of the following means: PayPal, TransferWise, Bank Transfer, and/or Revolut.

- When calculation of the profit target is being done, there is also a deduction of all the spreads, trading costs, overnight swaps, and commissions.

- Losses incurred as a result of violating the company’s risk management policies will also be deducted from the account balance just like for the Evaluation phase.

- Profits made in this phase due to a violation of CTI’s risk policies are also treated the same way as in the Evaluation phase.

Advantages and Disadvantages of CTI

What are the Pros of CTI for Forex Traders?

- Has a wide array of products and services

- Traders have access to practical educational content

- The presence of an engaged trading community helps polish traders and makes them better

- There is professional coaching from seasoned and veteran traders

- Availability of psychological consultation means traders get a professional opinion about the essential traits of their personalities which can then be harnessed over time to make them better traders.

What are the Cons of CTI for Forex Traders?

- The signup fees for different levels of the program are a bit above the industry average.

- The number of applicants approved per month is a bit low and might be discouraging for some traders.

- The program has strict rules which carry dire consequences if violated.

- Despite the claim that all nationalities are welcome, the program is most suited for people in the United Kingdom.

Want to know more about CTI? check this link.