Get 75% Off Lifetime & Half Price for Resets. Use Code: TF50 |

This article was written when the Topstep Forex program was still running, but since April 2022, Topstep has said Goodbye to Forex markets and invited their Forex community to join the Futures program.

Why did Topstep shut down the Forex program?

Most members of the Topstep team are Futures traders, and it becomes harder for them to follow forex traders and the forex market globally. When the TopSep was created in 2012, it included only a Topstep futures program, and the Topstep Forex program didn’t start until 2018, but after 4 years of operating this program, Topstep team has chosen to cancel the forex program and return to their original field of trading, Futures trading.

What is Topstep?

Topstep is a financial technology company that operates out of Chicago, Illinois in the United States. It is a company that focuses on the evaluation of the performance of day traders in real-time simulated accounts and it is recognized as one of the most trusted funded trading programs in the market. This evaluation serves as the basis which the company uses to choose traders that will have access to a Topstep funded trading account. The trader can then use this for trading Forex and futures contracts in the financial markets. Essentially, clients of this firm do not have to necessarily use their money to trade but rather use the firm’s capital.

Topstep is a top-notch platform that gives traders at all levels of experience the opportunity to effectively study the markets, available products, trading system, and mindset. This will allow the traders to design a profitable strategy that is suitable to their unique financial personality and goals. As an exclusive asset investment and funding firm, there is a membership program made available by Topstep Trader which allows the setting up of a simulated investment account for trading. The company then uses this to select traders as long as they meet certain performance criteria and can sustain that performance over a particular period.

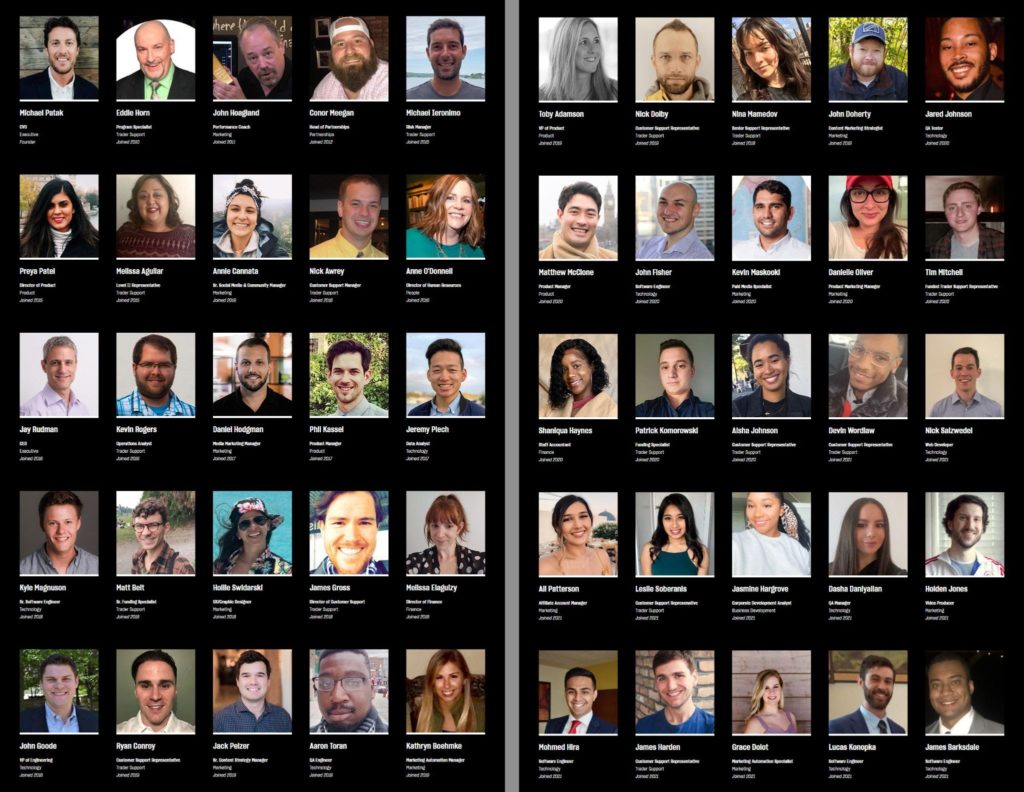

Topstep Team

The company was established by Michael Patek in 2012, who started his investment career with a capital of $90,000. The platform and simulated trading of forex and stock futures are designed in such a way that traders can perform critical thinking and carry out specific, well-tailored research. By providing traders with a platform to develop a range of important investment skills, Topstep is paving the way for traders to have increased chances of earning a substantial profit in the financial markets.

Topstep help Traders Enhance their strategies

On Topstep, traders gain experience through learning and practice which allows them to make informed decisions. Traders need to be dedicated and committed to the Topstep platform as that will determine their results; because the better you are, the higher your chances of being selected to trade with Topstep’s capital. The funding process of Topstep is made up of three steps. The first step involves evaluating the profitability of the trader, the second step involves assessing the trader’s risk management, and the third step is providing the selected trader with a funded trading account.

Valid platforms for TopstepFX

Topstep forex makes the MT4 trading platform available to its clients which allows them to trade with confidence. The MT4 supports features like strong analytics and charting software, along with a variety of add-on tools that ensure the trader is in control of their trades. MT4 is compatible with all kinds of devices.

CHALLENGE THAT Topstep OFFERS FOR FOREX TRADERS

The challenge is the Forex trading combine and it is such that after the trader successfully follows the rules and reaches the set goals, the trader is then given access to a fully-funded account that belongs to them. The Trading Combine is designed with the trader in mind. It provides rewards for excellent risk management and helps build effective trading habits that are long-lasting.

With the Forex Trading Combine, traders have a chance to trade forex in a simulated, real-time account. Once traders can show that they can trade frequently, manage risk effectively, and also make a profit, then they are bound to be recipients of a live funded account.

Trading Combine Steps

The Trading Combine is divided into two steps which enable a trader to be qualified for a Funded Account as long as they do well in both steps of the challenge. The goal is to meet the defined targets without breaking any of the rules. The Funded Account is structured in such a way that the traders receive 100% of the first $5,000 made in profits and 80% from subsequent profits while the firm always takes 100% of any losses.

In the First step, traders have to show their capabilities in making a profit without violating any of the predefined rules.

In the second step, the rules become more rigid to focus more on risk management which is another criterion that determines the selection of traders.

The Trading Combine subscription has to be renewed monthly from the sign-up date until the trader earns the Funded Account or decides to cancel the account. The renewal of the monthly subscription renewal has no impact on the trader’s account balance nor does it negate the violation of a rule.

What if I didn’t make it?

If a trader should violate any of the rules, there is a chance to reset their account any time by clicking on the ‘Reset’ button that can be found on the dashboard. However, this is accompanied by charges which could vary from $89 to $139 depending on the trader’s choice of account size. Choosing the ‘Reset’ button will maintain the progress made by the trader while also resetting the targets and rules, thus providing the trader with a fresh start at whatever step in the Trading Combine they were in before the reset. The reset, however, does not impact the date of monthly renewal.

more information about the reset here.

RULES IN THE Topstep CHALLENGE FOR FOREX

This section will examine the rules and targets of the two steps of the trading combine.

buying power

For all account types at TopstepFX, whether it is a Funded or Trading Combine Account, they feature a leverage of 100:1. This indicates that for every $1,000 in the trader’s account, they have $100,000 worth of buying power available to them.

the same leverage is used for most forex funded trading programs, including FTMO.

profit target

This is the realized amount that traders need to earn for them to move to the next step. Once the target is reached, the trader is expected to close all open trade positions after which they will be directed to the next step when the trade report uploads later that day.

weekly loss limit

Unlike FTMO, Topstep doesn’t have a daily loss limit, but it has a weekly loss limit. The weekly loss limit refers to the acceptable amount of money that a trader can lose during a particular trading week (Sunday through Friday). This allows the trader to quickly recognize when the trade is not favorable and probably take a break for the week to rethink the current strategy. Applying a weekly loss limit also teaches the trader discipline and adequate risk management which means traders are not quick to make decisions after suffering losses which can be more devastating because such decisions will be based on emotion rather than logic and proper research.

account loss limit

This refers to the highest amount of money that the trader can lose during the period that the account exists. This is a trailing number that is determined by the highest amount in the trader’s account balance. The account loss limit is important because it gives the trader a chance to identify and reexamine a strategy that is not suitable or working in the current market conditions. It also promotes smart management of the trading account.

How many days does you need to pass the trading combine and earn a funded account?

The time required to pass the Trading Combine is determined by the performance of a trader and the market; also, there is no limitation on the number of days required to pass it. The Trading Combine was designed in such a way that there are two Steps that active traders can successfully complete to give them a chance at earning a Funded Account within one calendar month.

How can a trader earn a funded account?

A trader can earn a Funded Account when they complete the Forex Trading Combine’s Step 1 and Step 2. To get through Step 1, the trader needs to display their ability to make profits by meeting their account’s Profit Target, without violating any of the rules. For step 2, the rules become more rigid to test the trader’s risk management and instill its importance into the mind of the trader.

The calculation of the Profit Target is done after the closure of all open trades. This simply means that before a trader can be considered for successful completion of the Trading Combine steps, then any open trades must have been closed.

Sufficient time is provided for traders to complete both Step 1 and Step 2. Once a trader completes Step 2, the trader will be notified, and their subscription will be turned off in preparation for opening a funded account. The funded account is then opened and completed in the space of 7 business days.

What is a reset?

This is a tool that is made available to traders which can be used at any time to reset their active Trading Combine account to its initial starting balance. Traders can also reset any violated rules on the account, which then makes the Trading Combine account qualified for funding again. Therefore, the reset provides traders with a chance to begin afresh anytime they need to while involved in the Trading Combine.

As mentioned earlier, using the reset comes with a charge which could vary from 89 dollars to 139 dollars depending on the account size that the trader has selected. To put it in a clearer perspective, the charge for a 200k trading combine account is 89 dollars, 99 dollars for 300k combine, and 139 dollars for 500k combine. But traders get to keep the initial progress made before using the reset option while also getting a reset of their targets and rules thus providing them with a new start at whatever step they were previously at in the Trading Combine. The reset can be done on the trader’s account at any time by clicking ‘Reset Account’ on the Trader Dashboard. Also, there are no limits to the number of times that resets can be used in the Trading Combine.

PROS AND CONS OF Topstep FOREX

Advantages of Topstep for Forex Traders

- There is free education available to traders through access to a video library and a blog section that will aid traders in expanding their knowledge.

- The platform compels traders into developing high standards of trading by instilling discipline in them and making them adopt proper risk management techniques.

- Traders can get started for free along with low commissions and competitive payouts of up to 80%.

- There is one-on-one coaching and mentoring from expert coaches provided by the firm and this helps to increase the success rate of traders.

- The firm does supply a large amount of trading capital to aspiring traders once they can complete the trading combine steps successfully.

- It is very suitable for individuals with a lot of time on their hands who hold an interest in becoming a better trader as the platform is an ideal place for individuals to hone their trading skills.

- The company offers 14 days of free simulated trial account with an initial balance of $150,000 and there is no requirement of a credit card to register for the free trial account.

- It provides top-notch and legitimate trading opportunities while also featuring a user-friendly dashboard that is well-equipped and straightforward to navigate.

- It gives traders with little capital the chance to access a much larger capital that can be used for trading.

- The firm does not discriminate because irrespective of an individual’s trading experience, anyone is liable to participate in the trading combine challenge as long as they are determined and committed to succeed.

- Traders with the firm’s Funded account get to keep the first $5,000 in profit and 80% of subsequent profits.

disavantages of Topstep for Forex Traders

- Traders do not usually have a real idea of what the evaluation will cost, as it might take them longer than projected to achieve the intended goal.

- The trading combine challenge is not easy to complete successfully and there are no refunds.

- If a trader does manage to get access to a funded account, a drop in performance could result in a loss of funding.

- Intraday loss rules exist which can cause funded traders to be constantly sent back to the simulator.

- A novice trader may find it especially difficult to complete the two-step evaluation tests.

- Funded traders are treated as professionals when the exchange fees are being paid which leads to higher monthly fixed costs for exchange data feeds.

- Even if a trader has a chance of getting funded, it is very difficult due to the rigid performance criteria which are very hard to meet.

- Simulator rules generally make it very tough for traders to be successful.

- There are additional costs incurred from performance coaching which is about $195 each month during the Trading Combine.

- The monthly membership fee is expensive in addition to about $99 on average for resetting simulator accounts.

Get 75% Off Lifetime & Half Price for Resets. Use Code: TF50 |