Get 75% Off Lifetime & Half Price for Resets. Use Code: TF50 |

Topstep, a proprietary trading firm, has implemented clear and straightforward rules that are designed to ensure a secure and structured trading environment. These rules guide how both Topstep and its traders operate, creating a mutually beneficial relationship. At Trading Funder, we emphasize the importance of adhering to these guidelines for safe and effective trading, as this is essential for any trader aiming for long-term success.

Topstep has specific rules tailored to each account type, including the Trading Combine® (evaluation), Express Funded Account™, and Live Funded Account™. Traders are also expected to meet Topstep’s trading objectives, which are crucial for progressing within the firm.

The key rules set by Topstep include managing losses within the Maximum Loss Limit, sticking to the designated trading hours, and avoiding prohibited financial instruments. The trading objectives focus on hitting the profit target, staying within the daily loss limit, and maintaining consistency.

Topstep also outlines rules for payouts and withdrawals, covering profit sharing, initial withdrawal limits, the frequency and timing of payout requests, and the minimum account balance required for transactions.

In this review by Trading Funder, we will closely examine Topstep’s rules, including those related to the Trading Combine®, funded accounts, and the specifics of their payout and withdrawal policies, to help traders choose the best prop firm and consult on optimal trading practices.

What are topstep Trading Combine rules?

Topstep Trading Combine Rules are a group of clear instructions and standards that traders have to stick to and achieve in the trading test or training program provided by Topstep.

There are 3 main rules that day traders should respect during the Topstep Trading Combine challenge. These include maintaining losses within the Maximum Loss Limit, adhering to the set trading hours, and not engaging with forbidden financial instruments.

1- Respect the Maximum Loss Limit

In Topstep Trading Combine, the Maximum Loss Limit (also called the Trailing Drawdown) is an important rule that stops traders account balance from dropping too much from its highest level during the trading test. It’s there to limit big losses and helps traders handle losses well, so a bad trading time doesn’t take away a lot of traders earnings.

The Maximum Loss Limit in the Topstep Trading Combine is determined based on the highest balance achieved in a trader’s account, referred to as the ‘high watermark.’ When a trader’s account value increases, the high watermark adjusts upwards accordingly. The Maximum Loss Limit is then set as a specific amount below this high watermark. For instance, in a $50K plan, if the trader’s account reaches a high watermark of $52,000, the Maximum Loss Limit is established at $50,000, meaning the trader is required to maintain their account balance above $50,000. This limit increases as the trader’s profits grow but does not decrease with any subsequent losses. Dropping below this limit constitutes a breach of the rule, necessitating a reset of the Trading Combine for the trader. The Maximum Loss Limit value in Topstep Trading Combine is calculated and set at the end of the trading day.

The table below shows the Maximum Loss Limit value for each account size:

| Account size | Maximum Loss Limit |

|---|---|

| $50K | $2,000 |

| $100K | $3,000 |

| $150K | $4,500 |

2- adhering to the set trading hours

In Topstep Trading Combine, the trading hours are set as rules to fit day trading. Positions must be closed by 3:10 PM Central Time from Monday to Friday, avoiding overnight holding. Trading resumes at 5:00 PM Central Time on weekdays and after the weekend pause, it restarts at 5:00 PM on Sunday.

3- trade only allowed instruments

In the Topstep Trading Combine, traders have access to a variety of futures contracts available on the Chicago Mercantile Exchange (CME). This range includes Equity Futures, for example, the E-mini S&P 500, as well as Currency Futures like the Australian Dollar. Additionally, traders can deal with Micro Futures such as the Micro E-mini S&P 500. The program further includes trading options in Agricultural, Energy, and Metal Futures, along with Cryptocurrency futures like Micro Bitcoin.

What are topstep Trading Combine Objectives?

In the Topstep Trading Combine, objectives serve as specific, measurable targets, such as reaching a profit goal, ensuring no single day’s profit exceeds 50% of total profits, and staying within the Daily Loss Limit. Violating these objectives during a trading session doesn’t disqualify traders from the program; instead, they have the opportunity to reset and try again in the next session. For example, exceeding the Daily Loss Limit leads to account auto-liquidation for that day, but it’s not considered a rule violation.

1- Reach and maintain the profit target.

In the Topstep Trading Combine, reaching and maintaining the profit target is a key objective. This target, a part of the Combine’s parameters, is essential for traders to progress in the program. Achieving it signifies the trader’s skill in profit generation and effective risk management. The minimum time to potentially meet this target is two trading days, but there’s flexibility in the timeframe; traders can take the time they need.

The table below shows the profit goal for each account size:

| Account size | Profit Goal |

|---|---|

| $50K | $3,000 |

| $100K | $6,000 |

| $150K | $9,000 |

2- not exceeding the daily loss limit

The Daily Loss Limit is a set financial objective for the Topstep Trading Combine. If the Net Profit & Loss (P&L) reaches or surpasses this limit during a trading day, the account is automatically liquidated for the rest of the day. This means all open trades are closed, pending orders are canceled, and no new trades can be made until the next trading day. The limit varies based on account size: $1,000 for a 50K account, $2,000 for a 100K account, and $3,000 for a 150K account. Exceeding the Daily Loss Limit doesn’t count as a rule violation and trading can resume in the next session. The Net P&L includes commissions, fees, and both unrealized and realized trade P&L.

3- respect the consistency target

The Consistency Target in the Trading Combine® is designed to assess a trader’s ability to generate consistent profits while effectively managing risk. The key criterion is that the profit from the trader’s best day must not exceed 50% of their total profits. If it does, the trader needs to continue trading until this percentage falls below 50%.

what are Topstep Live and Express Funded Account rules?

The Topstep rules for the Live Funded Account (LFA) and Express Funded Account (XFA) are critical guidelines for traders in these programs. These rules are designed to ensure risk management and disciplined trading in both virtual and live market environments.

There are 3 main rules that day traders should respect during the Topstep LFA and XFA, and they are almost similar to Trading Combine. These include:

- Maintain the Maximum Loss Limit: This rule requires traders to ensure their account balance does not drop to or below a predetermined maximum loss limit. This limit is enforced based on the Net P&L (Profit and Loss) of the trader’s account.

- Adhere to Specified Trading Hours: Trading is allowed only during the hours that align with the CME Group’s trading schedule.

- Engage Only in Permitted Instruments: Trading is restricted to instruments that are explicitly permitted by Topstep.

How do Topstep’s Live and XFA differ in calculating the Maximum Loss Limit?

A significant difference between the LFA and the XFA at Topstep lies in the calculation of the Maximum Loss Limit. In the Live Funded Account, the Maximum Loss Limit is calculated intraday, meaning it’s based on the real-time Net P&L and can trigger account closure or restrictions during the trading day if breached. In contrast, for the XFA, the Maximum Loss Limit is calculated at the end of the trading day.

What are Topstep objectives for Express and Live Funded Accounts?

Topstep Live Funded Account (LFA) and Express Funded Account (XFA) objectives refer to the specific goals and requirements set for traders in the funded account programs by Topstep. These objectives include:

- Achieving winning trading days with minimum profit: Completing a specified number of trading days where net gains meet or exceed a predetermined profit level.

- Following the Scaling Plan: Adhering to a predefined strategy that adjusts trading volume based on current account equity to manage risk effectively.

- Not exceeding the Daily Loss Limit: Ensuring that daily trading losses do not surpass a specified threshold to avoid deactivation of the trading account.

Achieving winning trading days with minimum profit

In Topstep’s XFA and LFA, traders have a key goal: to achieve a minimum of $200 net profit for five separate trading days. These days don’t need to be in a row. Achieving this goal is vital for those who want to withdraw earnings, as it allows them to request up to 50% of their account’s balance.

Following the Scaling Plan

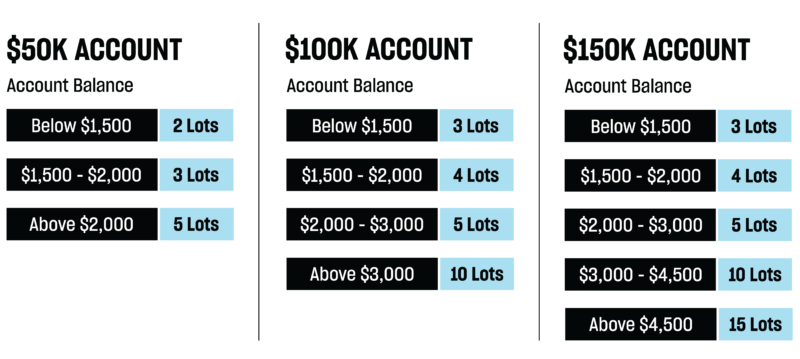

In Topstep’s XFA and LFA, the Scaling Plan changes how many contracts (lots) a trader can trade based on their daily profit or loss. If a trader does well, they can trade more contracts. If they don’t do well, they can trade less contracts.

The graph below shows information about the number of lots based on the size of your account and its balance:

Does Topstep have a consistency rule?

Yes, Topstep has a consistency rule, known as the “Consistency Target,” in the Trading Combine. This rule requires that a trader’s most significant winning day must not exceed 50% of their total profits. If a trader’s best day equals or exceeds 50% of their total profits, they need to continue trading until this percentage falls below 50%. However, this Consistency Target rule is specific to the Trading Combine stage and does not apply to the Express Funded Account or the Live Funded Account stages of the Topstep program.

what are Topstep withdrawal/payout rules?

The Topstep withdrawal (or payout) rules are a set of guidelines that dictate how traders can access and withdraw their earnings. Let’s analyze these rules:

- Eligibility for Payouts:

- Payouts are available only to traders with Funded Level accounts, either Express Funded Account or Live Funded Account.

- Payout eligibility requires a specific number of winning trading days. A winning trading day is defined as a day where the trader’s net PNL is $200 or more.

- Payout Frequency and Limits:

- After accumulating five winning trading days, traders can request a payout, capped at 50% of their account balance.

- Once a trader accumulates 30 winning trading days, they can access up to 100% of their balance for each payout. However, requesting a full 100% payout will close the Funded Account, as it brings the balance to the Maximum Loss Limit.

- Requesting a Payout:

- Payouts are requested through a form in the Topstep app.

- The processing time for payouts can be up to 10 business days.

- Payment methods include ACH (up to 10 business days) and International Wire/SWIFT (3-5 business days).

- Minimum Payout Amount:

- The minimum amount for a payout request is $125.00.

- Profit Split Policy:

- Initially, traders receive 100% of the profits from payouts, up to $10,000.

- After receiving $10,000 in cumulative payouts, the profit split changes to 90/10, with the trader receiving 90% and Topstep retaining 10%.

- Impact on Trading Account:

- After a payout request is processed, the Maximum Loss Limit in the account is automatically set to $0, meaning the trader cannot let the account balance go below this amount.

- Additional Considerations:

- Payout rules apply per trader, not per account, and can span across multiple funded accounts.

- Winning days in an Express Funded Account count towards the 30-day requirement for a Live Funded Account.

- Trading Combine Restrictions:

- Traders cannot take payouts from a Trading Combine account. Payouts are only possible after passing the Trading Combine and opening a Funded Level account.

- Citizens of certain ineligible countries cannot take payouts or earn funding with Topstep.

Is Topstep a Regulated Company?

Topstep, a proprietary trading firm based in Chicago, is not regulated by any financial authority. This is typical for prop firms like Topstep, which use their own capital for trading instead of handling client funds, thereby operating outside the regulatory scope of broker-dealers. They offer a funded trading program where traders use simulations to demonstrate their skills, and successful traders can access funded accounts. While the company takes safety measures like risk management to monitor its operations, it’s important for individuals considering Topstep to understand that it doesn’t provide the same regulatory protections as a traditional financial institution.

Is Topstep a legit Company?

Topstep, established in 2012, is recognized as a legitimate proprietary trading firm. It has a proven track record, indicated by its growth and over $14 million in trader payouts since 2020. The firm maintains transparency in its operations, highlighted by clear trading rules and a transparent profit-sharing model. Positive reviews on Trustpilot support its credibility. Topstep’s straightforward approach and educational resources further confirm its legitimacy in the trading industry. read our detailed review of Topstep’s legitimacy.

Conclusion on Topstep rules

Topstep offers a well-structured evaluation process, where traders must adhere to rules such as the Maximum Loss Limit and Daily Loss Limit, as well as meet specific trading objectives like hitting profit targets and maintaining consistency. With a clear profit-sharing system and flexible withdrawal options, Topstep is designed to support disciplined traders aiming to secure funded accounts. At Trading Funder, we find Topstep’s transparent rules and educational approach make it a strong choice for traders seeking structured growth and risk management in their trading journey.

Get 75% Off Lifetime & Half Price for Resets. Use Code: TF50 |