Click here & Get 5% off NOW. Use code: TF5off |

Update: SurgeTrader has permanently shut down and suspended all trading operations as of May 24, 2024, following unresolved licensing issues with Match-Trade Technologies.

SurgeTrader is a proprietary trading firm that provides a funded trading program tailored for forex traders globally. Their approach aims to help traders achieve significant profits by offering capital to trade in various financial markets. With a streamlined one-step evaluation and clear trading rules, SurgeTrader simplifies the process for traders to begin. The firm’s partnership with Valo Holdings ensures financial stability, while all funded accounts are managed through EightCap, a regulated broker. Trading Funder’s review highlights the firm’s excellent customer support and real-time trade analytics, which foster transparency and trust. Based on extensive trader experiences and reviews, this article delves into SurgeTrader’s offerings, rules, objectives, and overall legitimacy. Whether you’re a seasoned forex trader or just beginning, this SurgeTrader review by the Trading Funder team provides essential insights to help you choose the right funded trading program.

What is SurgeTrader?

SurgeTrader is a global prop trading firm based in the United States. It focuses on helping traders worldwide earn substantial profits across various financial markets, including Forex, Shares, Commodities, Indices, and Cryptocurrencies. The firm helps traders through its accelerated trader funding program that enables traders to gain access to a funded account once they pass the one-step evaluation known as the SurgeTrader Audition.

The firm partners with Valo Holdings, providing it with deep venture capital backing while offering security and stability to its finances. Also, capital investments are deployed toward long-term success instead of short-term gain, which means the firm will be looking for traders that desire consistent results over a long period rather than those that want a quick fix—the firm endeavors to foster trust among traders by maintaining openness and transparency.

The SurgeTrader funded program is structured so traders only have to undergo a one-step evaluation to get a funded account while dealing with straightforward trading rules. Also, there are no time limits on when to achieve trading objectives, and traders can enjoy top-notch customer support. Furthermore, all the funded trader accounts are managed through EightCap, a broker regulated by the Australian Securities and Investment Commission(ASIC), thus adding to the firm’s legitimacy.

The firm aims to help traders hone their talent and position them to succeed at trading. Once a trader can display excellent market navigation skills and solid risk management, he/she will get the chance to gain a funded account. Therefore, the firm provides traders with the best trading conditions facilitated by EightCap while traders also gain access to trade analytics in real-time. This will allow them to evaluate and improve their trading performance to generate profitable returns.

Who is the founders of SurgeTrader?

The founder of SurgeTrader is Jana Seaman, and she was recently recognized for her accomplishments by Gulfshore Business in September 2022. Her success with SurgeTrader was duly recognized owing to the success the prop firm has enjoyed in such a short period. Some of the accomplishments of SurgeTrader since it was founded by Jana include:

- Employee growth exceeding 200% in the year 2022.

- Paid out multiple millions of dollars in profits in 2022 to traders.

- Having a roster of tens of thousands of global traders and still counting.

- Making trader funding available in tens of millions in total.

She has capitalized on her solid background in trading financial markets to structure SurgeTrader to benefit traders. Together with her team of professionals, they can help traders enjoy long-term success in trading and finally gain the financial freedom they are looking for.

Is SurgeTrader a scam?

The manner of the firm’s operation and people’s experiences with the firm will determine how to answer this question. By how SurgeTrader is structured, it is hard to argue against its legitimacy, especially when it is partnering with a broker like EightCap, which is regulated by ASIC, one of the top financial regulatory bodies in the world. Furthermore, the firm’s processes are straightforward and transparent, with excellent customer support to answer any inquiries that traders may have.

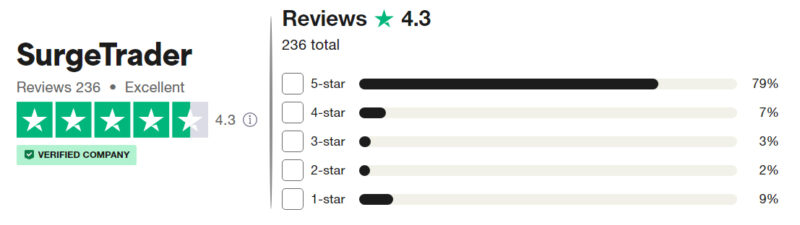

Going by people’s experiences given both on Trustpilot and on the company’s website, the reviews have been generally positive, with people commending the trading conditions as well as the customer support. Some also mentioned the payout add-on of 90% from 75% while commending the very low spread as well as the audition that is perceived to be fair, fun, and challenging. As such, many people recommend SurgeTrader for traders interested in forex trading, Indices, Shares, etc.

However, there are a few negative reviews that are to be expected when dealing with multiple people, as some have complained about the SurgeTrader Audition. But the SurgeTrader customer support was quick to reach out to such individuals and explain the reason they had such an experience. Overall, the company has gone to great lengths to structure its program in such a way that traders can benefit from and trade the various markets successfully.

SurgeTrader Offers and Prices for Traders

As mentioned earlier, SurgeTrader has a one-step evaluation known as an Audition that traders must pass to qualify for a funded account. The Audition has different tiers of accounts that traders can choose from, and the choice will depend on the trader’s ability and the amount of funds he/she is confident in managing.

There are six account tiers with varying fund sizes, and the list below examines their different features while giving traders an overview of what to expect.

- There is the Starter account with a fund size of $25,000, a profit target of $2,500 (10%), and an Audition fee of $250.

- The next account tier is the Intermediate account with a fund size of $50,000, a profit target of $5,000, and an Audition fee of $400.

- Another account tier is the Seasoned account which has a fund size of $100,000 along with a profit target of $10,000 and an Audition fee of $700.

- The next account tier is the Advanced account, which features a fund size of $250,000, a profit target of $25,000, and an Audition fee of $1,800.

- The penultimate available account tier is the Expert account which features a fund size of $500,000 and a profit target of $50,000, while the Audition fee costs $3,500.

- The last available account tier is the Master account which features a fund size of $1,000,000 with a profit target of $100,000 and an Audition fee of $6,500.

From the list of account tiers above, it is clear that the Starter account is the smallest among the offers of SurgeTrader, while the Master account is the biggest. It can also be observed that the bigger the fund size of the account, the bigger the profit target and the audition fee, which is to be expected. This is why traders should check the features of each account tier carefully before choosing because there will be no refunds if they fail their Audition or abandon an account tier. After all, it’s beyond their capacity.

| Account Tier | Fund Size | Profit Target | Audition Fee | Daily Loss Limit | Max Trailing Drawdown |

|---|---|---|---|---|---|

| Starter | $25,000 | $2,500 | $250 | $1,000 | $1,250 |

| Intermediate | $50,000 | $5,000 | $400 | $2,000 | $2,500 |

| Seasoned | $100,000 | $10,000 | $700 | $4,000 | $5,000 |

| Advanced | $250,000 | $25,000 | $1,800 | $10,000 | $12,500 |

| Expert | $500,000 | $50,000 | $3,500 | $20,000 | $25,000 |

| Master | $1,000,000 | $100,000 | $6,500 | $40,000 | $50,000 |

Note: The Max Trailing Drawdown and Daily Loss Limit are calculated based on the Fund

Other similar features that characterize all the account tiers include a Daily loss limit of 4% and a Max trailing drawdown of 5%. There is also a standard profit share of 75% and a standard leverage of 10:1 across all the account tiers. However, the profit share and the leverage can be increased to 90% and 20:1, respectively, via add-on purchases which will be discussed later in the article. Furthermore, the doubling of leverage from 10:1 to 20:1 is only available for Forex and Metals but not for other instruments offered by SurgeTrader.

What are SurgeTrader’s Rules and Objectives?

SurgeTrader rules are divided into two parts namely: Hard breach rules and Soft breach rules; both sets of rules apply to the Audition accounts as well as the live trading accounts.

Hard breach rules

The hard breach rules are those that if a trader breaks them, such a trader has failed the Audition and will lose the account. There rules are just two, namely:

- The Daily Loss Limit – 4%.

- The Max Trailing Drawdown – 5%.

Daily loss limit

The daily loss limit applies to the current equity for a particular day. For instance, a trader with an account tier of $100,000 will have a daily loss limit of $4,000. If the trader should make a profit of $10,000, the daily loss limit will increase to $4,400 – 4% of the trader’s new account balance of $110,000. This happens because the daily loss limit is based on a percentage and not a fixed $ amount which means the more profit a trader generates, the wider their daily loss limit will be, as seen in the initial example.

The daily loss limit is calculated based on the end-of-day balance of the previous day, as the daily loss limit always resets by 5 PM EST each day. For instance, if the end-of-day balance for the previous day is $100,000 on a $100K account, the account will breach once equity gets to $96,000 for that day.

Maximum trailing drawdown

The Maximum Trailing Drawdown at SurgeTrader refers to the maximum amount a trader’s account can draw down before the account gets breached. The initial level of the maximum drawdown is set at 5% of the initial account balance. As the trader’s account balance increases, the maximum trailing drawdown will follow in a similar direction until the trader achieves a profit target of 5% in the account.

Once the 5% profit target has been achieved by the trader, the trailing drawdown will be deactivated, which will allow the trader to draw back down to the initial account balance before the account is breached. This means that profitable traders can find themselves with a maximum trailing drawdown higher than 5%. The example below provides more explanation.

A trader with a $100,000 account can see the account fall to $95,000 before getting disqualified. If the trader generates profit and makes about $4,000 in the account, the new account balance becomes $104,000; the maximum drawdown limit thus increases to $99,000. If the trader generates an additional profit of $1,000, the account balance increases to $105,000, which is where it will lock in since the trader has achieved the 5% profit target in the account.

This means the max drawdown limit will stay at $100,000, but generating more profit and raising the account balance will lead to a higher maximum drawdown beyond 5%. If the trader goes on to grow the account to about $120,000, the effective maximum drawdown level rises to 20%, which is 4 times more than the initial level of 5%.

Soft breach rules

The soft breach rules are those that breaking them will only lead to the closing of positions that led to the violation, but the account will be safe, which means trading can continue. These rules include the following:

- The Stop-loss required for each trade during the period of executing the trade.

- Flat for the weekend, which means closing all positions overnight and on weekends. For this rule, traders must close their positions at 3:55 PM EST on Fridays.

- Maximum open lots with risk

Stop-loss required for each trade

In SurgeTrader, the soft breach rule “Stop-loss required for each trade at the time the trade is executed” means that traders are required to set a stop-loss order for each trade they make at the time the trade is executed. In other words, traders must determine the maximum amount they are willing to lose on a trade, and set a stop-loss order accordingly. By doing so, the trader can limit potential losses if the trade moves against them, and reduce the risk of breaching the daily loss limit or the max trailing drawdown.

Flat for the weekend

The SurgeTrader rule “Flat for the weekend” means that traders must close all of their positions overnight and on weekends. This is done to avoid any sudden market changes or price gaps that may occur when the market opens on Monday, which could result in significant losses.

To comply with this rule, traders must close their positions at 3:55 PM EST on Fridays. This means that they must exit all of their trades by this time and cannot open new trades until the market opens on Monday. This rule ensures that traders do not leave any open positions during the weekend, which can be risky due to potential market volatility.

Maximum open lots

The maximum number of open lots concerns the limit on the number of open lots available to a specific account tier. For instance, if a trader opts for the $100K account, there are 10 open lots available to the trader. If the trader should purchase 5 lots of GBP/EUR at 1.20 while having a stop-loss at 1.18, that means the trader will have 5 lots with risk while still having another five lots available. If the GBP/EUR then moves up to 1.25, causing the trader to update the stop-loss to 1.20, which will be equal to the trader’s opening price for the asset, this means there will be no more risk on that trade.

Therefore, the trader will have 10 lots available once again, even though 5 lots are currently open. The trader should endeavor to open only a few trades with risk as the SurgeTrader system will automatically liquidate all trades currently with risk. However, since this is one of the soft breach rules, this means that traders can continue trading. Also, as long as they achieve the profit target of 10% for their chosen account tier, they would be upgraded to a live funded account if they avoid violating the two hard breach rules.

Questions and Answers about SurgeTrader

What are SurgeTrader add-ons?

SurgeTrader add-ons are additional benefits that a trader gets when they purchase an account tier. These benefits include the absence of stop-loss, a 90% profit split which is an increase from the original 75%, and a multiplication of the leverage from 10:1 to 20:1. These add-ons come with all the account tiers, and traders can choose to purchase them alongside the chosen account tier.

What is the estimated timeframe to become a funded trader with SurgeTrader?

There is no timeframe required to become a funded trader, as SurgeTrader allows traders to take as much time as possible to be profitable while abiding by the rules, which simply means generating a return of 10% on the selected account tier without incurring a daily loss limit of 4% or a 5% maximum trailing drawdown. This is different from some other firms where they enforce a minimum number of trading days while also putting a limit on the number of days in which traders need to pass the challenge to qualify for a funded account.

SurgeTrader only wants traders to take advantage of its various account tiers, simple trading rules, and excellent trader support so that they can be firmly positioned to succeed over a long period. Therefore, traders are not limited to a particular timeframe which means they can take their time to become profitable and qualify for a funded account.

What occurs after passing the SurgeTrader challenge?

After passing the SurgeTrader challenge, the trader will get a funded account within 24-48 hours. The process involved is that the trader will get an email from DEEL, the withdrawal payment processor of SurgeTrader. The email will contain information on what the trader needs to set up a DEEL account, after which 24-48 hours should be allowed after registration of the account to complete the setup of the funded account.

What is the profit split?

The standard profit split is 75:25, in which 75% of the profit goes to the trader while the company retains the remaining 25%. However, by paying a little extra fee to purchase add-ons alongside the account tier, the profit split can be increased to 90% for the trader while the remaining 10% will go to the company.

What is the profit withdrawal process at SurgeTrader?

Traders can withdraw profits at any time in their trader dashboard, but the frequency must be limited to once every thirty days. This means that if a trader makes profits in their live account on the first day, such a trader can withdraw that profit. Also, if the trader prefers to leave the generated profits in the account to allow them to accumulate and scale the account, that is allowed.

To withdraw, the trader only needs to click the button that signifies Withdraw Profits in the trader dashboard and input the amount to be withdrawn. All the profits are distributed in collaboration with DEEL. Once the withdrawal is approved by SurgeTrader, the profits will be reflected in the trader’s DEEL account, and they can then be withdrawn via any available methods offered by DEEL.

Furthermore, when a withdrawal is approved, SurgeTrader will likewise withdraw its share of the profits while the trader’s max trailing drawdown will lock in at the starting balance. It should be noted that the trailing drawdown does not reset when a trader requests a withdrawal. For instance, a trader working with an account size of $100,000 generates substantial profits, which raises the account balance to $120,000. The trader then requests a withdrawal of $16,000, which means the trader will be getting paid $12,000 while SurgeTrader will retain the remaining $4,000 in a profit split of 75% to 25%.

The account balance will then drop to $104,000, which locks the max loss limit at $100,000. Therefore, the trader will have a maximum of $4,000 that he/she can lose on the account before that account breaches the rule of the maximum trailing drawdown.

What is the account size that a trader will manage?

Traders will get the same live account balance as the one they selected for the SurgeTrader Audition. Once the trader passes the audition, assessment, and verification of the results will be carried out, after which the trader will be given credentials to a live account. On the live account, the trader will be eligible to receive 75% of the revenue generated while also having the option of purchasing an add-on to raise the profit share to 90%.

Traders should note that there are no upgrade options for the account size when it comes to living accounts, and this is why traders are advised to choose the right account size during the application process for the SurgeTrader Audition.

What are the trading hours?

The trading hours are set by EightCap, the broker that SurgeTrader partners with, which means the firm has no control over those hours. However, traders can easily find the specific trading hours for each product by checking the Specifications on their chosen trading platform. To navigate to the trading hours, right-click on any product in the Market Watch window of either the MT4 or MT5 platform and then choose Specifications from the dropdown menu.

It should be noted that on normal market days, Single Stock CFDs open five minutes after and close five minutes before normal hours of the US Stock Market. Also, holidays can affect the available trading hours for all products.

What instruments are available for trading?

There is a collection of CFD market instruments available for trading, which include Forex, metals, indices, oil, cryptocurrencies, and stocks. The trading platforms offered by EightCap determine the number of stocks that will be available to the trader, as MT4 offers about 90 while MT5 offers 250.

How much leverage is available to traders?

The leverage for Forex, Indices, Metals, and Oils is 10:1, while individual stocks have a leverage of 5:1, and the leverage for cryptocurrencies is set at 2:1. There is an option for traders to purchase an add-on at checkout that will allow them to access increased leverage of 20:1 on metals and forex.

Are traders allowed to hold stock trades into earnings releases?

No, traders are not permitted to hold stock trades into earnings releases. For traders to avoid breaching this rule, they are thus advised to close all Single Share Equity CFD positions by 3:50 PM Eastern Time on the day of the release if it is an aftermarket release. However, if it is a before-market-opens release, positions must be closed on the day preceding the release.

Violating this rule will be seen as an instant and hard breach of the account, leading to losing the account, while any gain or loss on that particular trading position will be eliminated from any payout calculations.

If my account is inactive for a specific time frame, what will be the result?

If a trader fails to place a trade at least once every thirty days, then such an account will be deactivated. This is because the broker that the firm is partnering with deletes inactive demo accounts after 30 days, but this is considered a soft breach by SurgeTrader.

Therefore, if the firm can reactivate the existing account, then it will, and if not, a new account will be created that will carry the same information and progress as the previous one whether it is the P&L or highwater mark (highest account balance obtained).

Can I scale my account?

Yes, SurgeTrader allows traders to scale their accounts. Once traders pass the SurgeTrader Audition, they will be presented with two choices. They can either decide to claim a fully funded account or extend their Audition which will allow them to scale to the next largest account size. If the trader decides to scale up to the next largest account size, then such a trader must continue the Audition and generate an additional profit of 10%.

With each increase of 10% profit, traders will still be presented with the same two options mentioned earlier, and they can either take the fully funded account at that point or continue to scale up to a million dollars in funding. However, it should be noted that if the trader should breach the account at any point during the scaling process, that Audition will be canceled, and the trader will have to retry the Audition.

What trading platforms are available for me to use?

There are two trading platforms that SurgeTrader makes available: the MT4 and MT5, which are widely seen as universal platforms in the over-the-counter trading industry. The two platforms are offered via the SurgeTrader broker, EightCap. The MT4 and MT5 accounts operate on the Raw account types at EightCap.

What is the available information on the dashboards of the trading account?

The information that traders can find on trading account dashboards consists of metrics that encompass profit target, equity, balance, daily loss limit, monthly return, maximum drawdown, and projected annual return. Also, traders will gain access to a detailed account history of every executed trade.

Why does the SurgeTrader Audition have a fee?

There are a couple of reasons for a SurgeTrader Audition fee, and the first reason is that the fee accounts for various operating expenses incurred by SurgeTrader, such as customer service functions, technology platforms, marketing, personnel, and all the other necessary expenditures that contribute to a company’s healthy growth.

The second reason is that the fee ensures the trader’s dedication to the process while also being committed to adopting trading practices that are disciplined and bound to lead to success. When a trader has some level of investment in the program, such a trader will have the necessary motivation to manage the account diligently and responsibly with the utmost care.

The fee is merely a small token of commitment that is bound to be rewarded with at least thousands to hundreds of thousands of dollars in real trading capital. After all, this fee is the only capital that traders are risking, which means the whole arrangement is tilted in their favor. They cannot lose more than this Audition fee, as SurgeTrader covers any losses suffered on a live-funded account.

A final reason for the fee is that it functions as a filter for SurgeTrader to identify serious-minded traders. The SurgeTrader community only works when it consists of committed traders that are capable of generating profit consistently. With limited resources, the process of the SurgeTrader Audition shows those that are solid and serious traders. Overall, the SurgeTrader program is a highly valuable service that many people will benefit from, and the service is adequately priced to support such a beneficial relationship.

Pros and Cons of SurgeTrader

Let us now conclude this review by examining the pros and cons of SurgeTrader.

What are the advantages of SurgeTrader?

- SurgeTrader features a favorable profit split for the trader at 75% which can be easily increased to 90% by purchasing an add-on.

- The payment for the SurgeTrader Audition is a one-time payment and not a recurring one.

- The Audition process involves only one step, which makes it quite straightforward while having clear and transparent rules that can be followed easily.

- There are no limits on trading strategies and investment styles that traders can adopt.

- The profit target is set at 10% of the total account balance, which is relatively low and realistic, with no minimum number of days to achieve the target.

- Traders gain access to a free 30-day membership with BKForex, which provides benefits ranging from trading tools to daily trading ideas, webinars, exclusive trading indicators, and more.

- The processing time for withdrawals is quite fast, with no limitations on the minimum or maximum amount that can be withdrawn, while the requests can be made at any time once in thirty days.

What are the disadvantages of SurgeTrader?

- Traders are not allowed to maintain open trading positions over the weekend, which might make it difficult to execute long-term strategies.

- The leverage level is relatively low, set at 10:1 for forex, metals, oils, and Indices, while it is 5:1 for stocks, and 2:1 for cryptocurrencies.

- Each trade must have a stop-loss set up to ensure a loss limit of 4% for each day.

- The additional educational information available to users is quite limited.

Conclusion on SurgeTrader

SurgeTrader offers a straightforward funded trading program, appealing to forex traders globally with its one-step evaluation and clear rules. With account sizes ranging from $25,000 to $1,000,000, traders benefit from a favorable 75% profit split, which can increase to 90% through add-ons. The firm’s partnership with EightCap, a regulated broker, and its emphasis on transparency and customer support make it a reliable choice. While the stop-loss and weekend position rules might limit long-term strategies, SurgeTrader’s low profit target and fast withdrawals provide flexibility and opportunity for consistent traders.

Click here & Get 5% off NOW. Use code: TF5off |