FTMO, founded in 2015 in Prague by by Otakar Šuffner and Marek Vašíček, has become a top player in the prop trading industry. The firm identifies skilled traders through a 2-step evaluation process—FTMO Challenge and Verification. Trading Funder team identified that Successful traders are granted access to FTMO Accounts, where they can trade with up to $400,000 in virtual capital and retain up to 90% of the profits.

FTMO offers trading in Forex, indices, commodities, stocks, and cryptocurrencies. Account sizes range from $10,000 to $200,000, with options for standard or Swing accounts.

Trading Funder checked FTMO’s Trustpilot, where it has a 4.8/5 rating, which reflects a lot of positive feedback from traders. Users generally praise FTMO for its quick payouts, transparent rules, and helpful customer service. Many appreciate the no-risk environment it offers through demo trading while still providing real financial rewards for successful traders. On the flip side, Some traders mention negatives like strict rules (especially on drawdowns), occasional delays in evaluations, and communication issues during the challenge, though these are less common.

Key advantages of FTMO include quick payouts, clear trading rules, and the ability to trade with no risk to your own capital while keeping up to 90% of profits. The tools and support, like the mentor app and trading analysis, also help traders improve. On the downside, there are strict rules on drawdowns, occasional delays in processing evaluations, and sometimes communication issues during the challenge phase.

FTMO offers different account types through its FTMO Challenge and Verification stages. The price for these accounts ranges from around €155 to €1080, depending on the account size and risk settings. Account sizes can go from $10,000 to $400,000 in virtual capital. Traders access these accounts on popular platforms like MetaTrader 4, MetaTrader 5, cTrader, and DXtrade, depending on their preference.

FTMO’s trading rules are strict. The Daily Loss Limit is 5%, and the Maximum Drawdown is 10%. There’s no maximum position size, but leverage is capped at 1:100. You can’t hold trades over the weekend unless using a Swing account, and there are restrictions for major news events unless you’re on the Swing account. Hedging is allowed, and Expert Advisors (EAs) are permitted. The Scaling Plan increases account size by 25% for consistent profitability. There’s no rule against any trading style or copy trading, but you must maintain consistency in your trades.

In this article, Trading Funder offers an in-depth review of FTMO, covering its key features, account types, and trading rules to help guide your experience with this prop trading firm.

What is FTMO?

FTMO was founded in 2015 in Prague by Otakar Šuffner and Marek Vašíček. They created the firm to support traders through a two-step Evaluation Process: the FTMO Challenge and Verification. Successful traders can access an FTMO Account, where they manage virtual capital and keep up to 90% of profits.

FTMO specializes in markets like Forex, commodities, indices, stocks, and crypto. Traders need to pass the Evaluation Process by meeting profit and risk management targets without exceeding loss limits.

A forex prop trading firm like FTMO funds traders to trade on its behalf. Traders don’t risk their own money, but instead work with the firm’s capital and share in the profits.

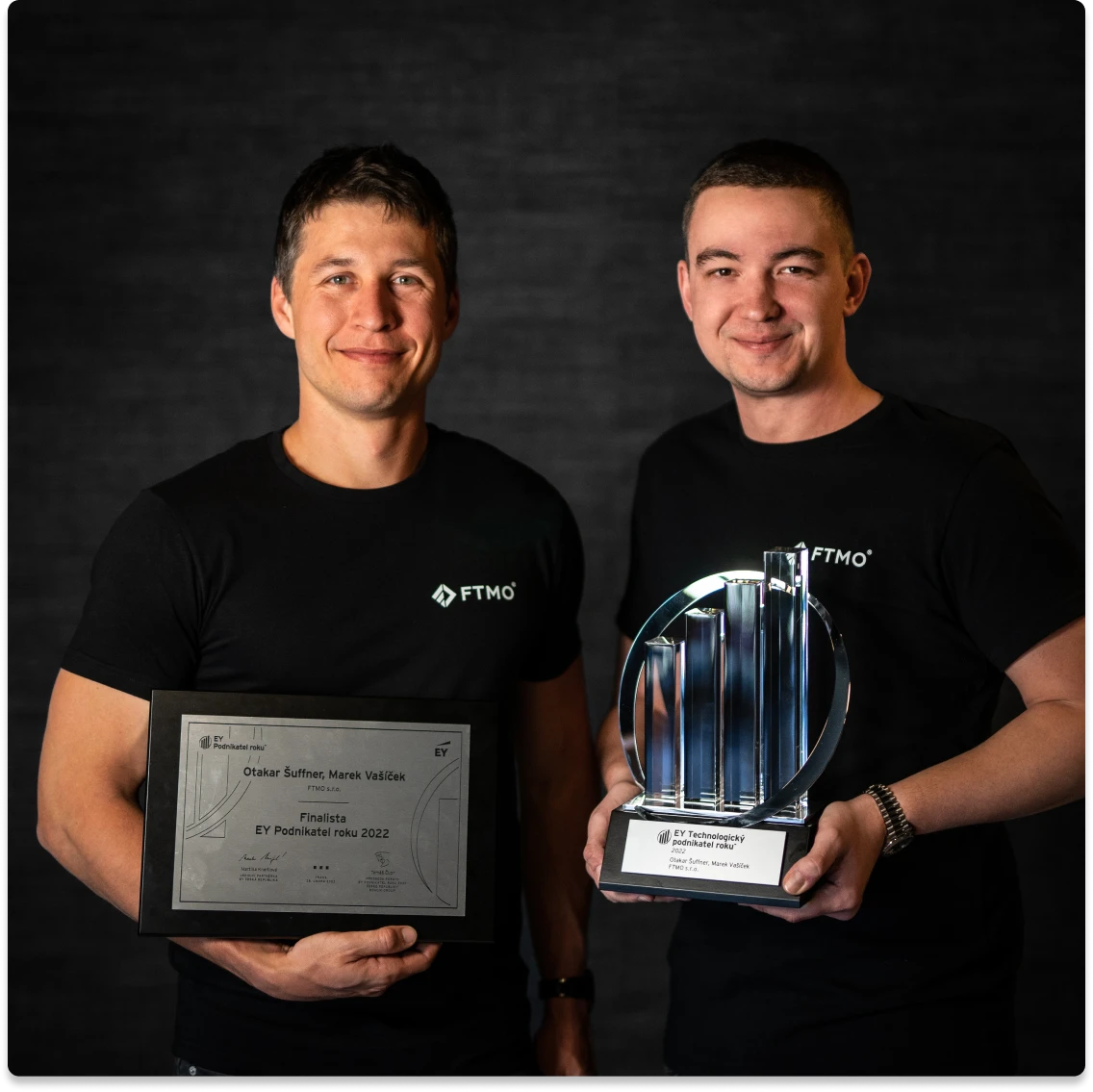

who is FTMO’s founder?

FTMO was founded by Otakar Šuffner and Marek Vašíček in 2015. Both studied finance and began their trading careers in Prague. Initially, they focused on futures and forex trading but needed more capital to grow. This led them to create FTMO, first targeting the Czech market under the name Získej účet. Over time, FTMO expanded globally, becoming a well-known prop trading platform that allows traders to manage company funds.

What makes FTMO Legit?

FTMO is widely considered legitimate for several reasons. First, it has been operating since 2015 and has built a strong reputation, having paid out over $160 million to traders by 2023. It has also earned recognition from major awards like Deloitte’s Technology Fast 50 and EY’s Entrepreneur of the Year, further boosting its credibility. FTMO offers transparent rules, no hidden fees, and the payouts are consistently praised by users, ensuring traders get their share of the profits without hassle.

On Trustpilot, FTMO holds a strong 4.8/5 rating based on more than 14,000 reviews. About 93% of users gave it a 5-star rating, appreciating the clear evaluation process, good customer service, and reliable payouts. However, a small percentage of users raised concerns about payout disputes or specific trading rules like lot size limits. Issues like delays in receiving funded accounts also appeared, though they seem rare.

Does Makes FTMO send payouts to its traders?

FTMO sends payouts to traders in a straightforward and transparent manner. Traders can request a payout after 14 days from their first trade on a funded account. The default profit split is 80% to the trader, with the potential to increase to 90% under FTMO’s Scaling Plan, allowing traders to keep most of their profits. Payouts can be requested on-demand or scheduled monthly, offering flexibility. Payment methods include bank transfers, Skrill, and cryptocurrencies, and FTMO does not charge any withdrawal fees. Most payouts are processed within 1 to 2 business days. Reviews generally praise the reliability and speed of FTMO’s payouts, though occasional delays have been reported, albeit rarely.

Does FTMO have good User Reviews and Testimonials?

FTMO has excellent user reviews, particularly on Trustpilot, where it holds a strong 4.8/5 rating based on over 13,000 reviews. The majority of traders—about 92%—gave it a perfect 5-star rating, praising the clear rules for the FTMO Challenge, prompt and reliable payouts, and responsive customer service. Positive feedback often highlights the transparency of the platform, quality trading conditions, and the availability of educational tools and performance analysis.

However, some negative reviews exist, mainly from traders who failed the evaluation due to strict rules around losses or delays in receiving funded accounts. Complaints about specific issues like lot size limits also appear occasionally, but these are rare compared to the overwhelmingly positive experiences shared by users.

Does FTMO have good Customer Support?

FTMO has excellent user reviews, particularly on Trustpilot, where it holds a strong 4.8/5 rating based on over 13,000 reviews. The majority of traders—about 92%—gave it a perfect 5-star rating, praising the clear rules for the FTMO Challenge, prompt and reliable payouts, and responsive customer service. Positive feedback often highlights the transparency of the platform, quality trading conditions, and the availability of educational tools and performance analysis.

However, some negative reviews exist, mainly from traders who failed the evaluation due to strict rules around losses or delays in receiving funded accounts. Complaints about specific issues like lot size limits also appear occasionally, but these are rare compared to the overwhelmingly positive experiences shared by users.

What are FTMO’s advantages?

Here are the key advantages of FTMO:

- High Profit Split: Traders can earn up to 90% of profits, starting at 80%, with opportunities to increase through the Scaling Plan .

- Scaling Plan: Consistently profitable traders can see their account balance increase by 25% every four months, with the potential to manage up to $2 million .

- Low Risk for Traders: FTMO provides trading capital, allowing traders to manage accounts up to $400,000 without risking their own money .

- Multiple Trading Platforms: FTMO offers access to MetaTrader 4, MetaTrader 5, cTrader, and DXtrade, catering to different trading preferences .

- Educational Support: FTMO provides tools like performance coaches, trading journals, and Account MetriX to help traders improve and maintain discipline .

- No Maximum Time Limit for Challenges: Traders can take as long as they need to pass the challenge, giving flexibility to meet objectives .

- Free Trial: A 14-day free trial allows traders to practice without financial commitment before starting the full challenge .

- Prompt Payouts: Traders can request payouts as soon as 14 days after their first trade, with fast processing times .

What are FTMO’s disadvantages?

Here are the main disadvantages of FTMO:

- Strict Trading Rules: FTMO has strict daily and overall loss limits (5% daily and 10% overall), which some traders find difficult to manage. Violating these rules can result in immediate failure of the challenge.

- Evaluation Pressure: The FTMO Challenge requires traders to meet a 10% profit target within 30 days (Phase 1) and 5% within 60 days (Phase 2). This pressure to perform within a set timeframe can be mentally challenging.

- No Weekend or High-Impact News Trading: Traders are not allowed to hold positions over the weekend or trade during high-impact news events, which can limit some trading strategies.

- Fees for Evaluation: There is a fee to participate in the FTMO Challenge, ranging from €155 to €1080 depending on the account size. While this fee is refundable upon the first payout, it’s a financial commitment upfront.

- Demo Accounts: Even after passing the challenge, traders only use demo accounts. Although profits are real and paid out, the trading itself remains simulated, which might not suit all traders.

- Max Capital Allocation Limits: FTMO caps the maximum allocation at $400,000, which may restrict traders looking to manage larger amounts.

These points highlight some of the key challenges and limitations traders may face with FTMO.

What is FTMO’s Pricing?

Here is a breakdown of FTMO’s pricing for each account type and size:

| Account Type | Account Size | One-Time Fee |

|---|---|---|

| Normal | $10,000 | €155 |

| Normal | $25,000 | €250 |

| Normal | $50,000 | €345 |

| Normal | $100,000 | €540 |

| Normal | $200,000 | €1,080 |

| Aggressive | $10,000 | €250 |

| Aggressive | $25,000 | €345 |

| Aggressive | $50,000 | €540 |

| Aggressive | $100,000 | €1,080 |

FTMO charges a one-time fee for each account, and there are no recurring monthly fees. The fee is refunded with the first profit payout

Does FTMO offer price discounts?

FTMO does not offer coupon codes. The best way to get all available discounts, including a 5% discount, is by using this link: FTMO discount link. They also offer a free trial, and their $10k account is currently available for just €89. Plus, if traders successfully pass the evaluation, they will get a full refund of the initial fee, making it a cost-effective way to start with FTMO.

Does FTMO allow multiple accounts?

FTMO allows traders to have up to 10 active accounts simultaneously. These accounts can be merged if they share the same risk setup and currency. The total capital allocation across these accounts is capped at $400,000, but this can be increased through FTMO’s Scaling Plan.

Does FTMO offer Free Trial?

Yes, FTMO offers a Free Trial, allowing traders to practice without paying an entry fee. It provides access to trading tools and a performance analysis. You can take the Free Trial multiple times by signing up on FTMO’s website.

Does FTMO offer a swing trading account?

Yes, FTMO offers a Swing Account for traders who want to hold positions overnight or over the weekend. This account doesn’t have restrictions on trading during news events or market closures, unlike the regular account. To access it, select the Swing Account option when starting the FTMO Challenge.

How does FTMO work?

Here’s a step-by-step guide on how FTMO works:

- Visit FTMO’s Website: Start by visiting the FTMO website to learn about their prop trading model and sign up.

- Choose a Free Trial or Start the FTMO Challenge: New traders can take a free trial, which simulates the real FTMO Challenge. If ready, sign up for the actual FTMO Challenge by choosing your risk level and account size. This step comes with a one-time fee.

- Complete the FTMO Challenge: Trade on a demo account with virtual capital. You need to meet specific trading objectives, including a 10% profit target within 30 days, while staying within daily and overall loss limits.

- Proceed to Verification: If you pass the Challenge, you move to Verification. The profit target is reduced to 5%, but the rules around risk management remain the same. There’s no time limit for completion .

- Become an FTMO Trader: Upon successful Verification, you receive an FTMO Account (demo) with the same capital size as in the Challenge. You can now trade for real profit and receive up to 90% of the profits .

- Scaling Plan: If you perform consistently, FTMO may increase your capital by 25% every four months.

- Withdraw Profits: You can withdraw profits 14 to 60 days after your first trade on the FTMO Account. Payouts are processed through various methods like bank transfers or crypto .

What are FTMO’s Rules and Objectives?

Here are the main FTMO rules and objectives:

- Daily Loss Limit: Traders must not exceed 5% of the account balance in losses on any given day. This rule ensures risk is managed tightly.

- Maximum Drawdown (Maximum Loss): A 10% total loss limit is imposed. If a trader hits this limit, the account fails.

- Leverage Limit: FTMO allows leverage of up to 1:100 across all accounts, providing flexibility without overexposure.

- Consistency Rule: Traders must demonstrate consistent performance, ensuring that profits are not just from a few large trades.

- Holding Over Weekends: Most FTMO accounts do not allow positions to be held over the weekend, except for the Swing Account, which permits it.

- Holding Over Major News Events: FTMO restricts trading during significant news releases unless using a Swing account.

- Hedging: FTMO allows hedging, meaning traders can open opposite positions in the same instrument.

- Scaling Plan: Successful traders can increase their account size by 25% every four months if they meet specific profitability and consistency requirements.

- Use of Expert Advisors (EAs): EAs are allowed, but traders must be cautious not to use overactive or third-party EAs that could trigger account restrictions.

- Trading Style Restrictions: FTMO supports most trading styles, including scalping, swing trading, and using EAs, as long as traders follow proper risk management.

- Copy Trading: Copy trading is allowed, but if multiple accounts are found using identical strategies, they may face restrictions.

The table below summarizes the key rule details for FTMO’s Challenge, Verification, and Funded Account phases, highlighting important parameters such as profit targets, loss limits, leverage, and restrictions on trading styles:

| Rule/Parameter | FTMO Challenge (Phase 1) | Verification (Phase 2) | Funded Account |

|---|---|---|---|

| Profit Target | 10% of initial balance | 5% of initial balance | No target |

| Daily Loss Limit | 5% of initial balance | 5% of initial balance | 5% of account balance |

| Maximum Drawdown | 10% of initial balance | 10% of initial balance | 10% of account balance |

| Leverage Limit | 1:100 | 1:100 | 1:100 |

| Minimum Trading Days | 4 days | 4 days | No minimum |

| Holding Over Weekends | Not Allowed (except Swing) | Not Allowed (except Swing) | Not Allowed (except Swing) |

| News Event Trading | Not Allowed (except Swing) | Not Allowed (except Swing) | Not Allowed (except Swing) |

| Hedging | Allowed | Allowed | Allowed |

| Scaling Plan | Not applicable | Not applicable | 25% capital increase every 4 months if conditions met |

| Use of EAs | Allowed | Allowed | Allowed |

| Copy Trading | Allowed with caution | Allowed with caution | Allowed with caution |

This table outlines the key rules and objectives for FTMO across the Challenge, Verification, and Funded stages

Which trading platforms does FTMO use?

FTMO uses several trading platforms, giving traders flexibility. The platforms include:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- DXtrade

These platforms provide advanced charting tools and are available on desktop, mobile, and web.

What brokers does FTMO use?

FTMO partners with multiple brokers to provide traders with a seamless trading experience. Two of the key brokers mentioned are Purple Trading and IC Markets. Purple Trading is known for its reliable platform and customer service, while IC Markets offers low spreads and fast execution, ideal for high-frequency trading. FTMO may update its broker partnerships over time to ensure optimal trading conditions.

Does FTMO allow trade copiers?

Yes, FTMO allows the use of trade copiers, but with limitations. You can use a trade copier to copy your own trades across multiple FTMO accounts. However, copying trades from external sources or other traders can violate FTMO’s rules and risk account termination.

Conclusion about FTMO

According to Trading Funder’s review, FTMO stands out for offering traders a solid opportunity to trade with significant capital while minimizing personal financial risk. Its strongest point is the high profit split, allowing up to 90% of profits for successful traders. On the downside, FTMO’s strict risk management, especially the daily loss limits, can make it difficult for some traders to succeed. Overall, it’s a reputable choice for disciplined traders looking for a funded account.